Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start Now- Timely payment as per contractual terms

- Payment advice on time and ease of bill tracking

- Continuous updation payments made and outstanding

- Easy process of bill submission

- Proper aging of vendors & accuracy of deductions and adjustments

- Timely closure of Accounts Payable

- Processing with speed and efficiency

- Minimum manual intervention

- Vendor masters sanitized with accurate vendor e-mail ID, bank details and payment methods (e.g. daft, cheque, NEFT)

- ERP enhanced to capture standard payment terms including those in text format

- Scan room and Indexing process introduced for receiving, tracking and validating vendor Invoices through work-flow tool

- Manual payment replaced by automated payment run based on payment due date. Host-to-host connection with bank established.

- Automated payment advice to vendors and online payment report for internal users

- Both physical and soft bills submitted directly to scan room with instant capture

- Validation and duplicate check done instantly on the system during Indexing

- Queries and approvals addressed online, delays minimized, greater transparency achieved

- Payment due date auto-determined and fetched from PO payment terms

- Bills auto processes as per due date and Vendor open items cleared for proper ageing

- Tax UTR Nos. auto-uploaded through reverse feed from bank

- Email payment advice auto triggered

- Meeting the collection and cash projection

- No discrepancy in negotiation of customer LCs

- Adherence to terms of payment and credit

- Timely MIS to flag overexposure and credit risks

- Proper aging of receivables and balance confirmation from customers

- Timely closure of accounts receivable

- Processing speed and efficiency

- Minimum manual intervention

- Host-to-host connection with banks and Virtual Account Nos.(VAN) for each customer

- Auto posting of customers payments on quoting VAN

- Customer LCs captured in Exim tool and creating a financial document in ERP

- Sales order and invoice created in ERP against the financial document

- LC negotiation documents generated from Exim tool

- Auto credit check enabled; sales order allowed only if sufficient credit limit exist

- Credit limit updated by incoming payments/ financial documents/ security deposits

- Customer payment auto posted as opposed to manual posting

- LC documentation generated from Exim tool, where all information is already available

- Ledgers updated on real-time basis and overdue outstanding monitored

- Credit limit updated faster, keeping dispatches uninterrupted

- Risk of supply beyond credit limit eliminated through automated credit check

- Tax UTR Nos. auto-uploaded through reverse feed from bank

- Information to Treasury faster and more accurate, helping better cash management

- All relevant documents to be easily available during processing

- Digital workflow for queries, approvals and reminders to be built

- Easy submission of invoice and requests from remote locations

- E-Invoice submission by vendors without delay and risk of loss

- Minimize hard copy retrival, documents available with transaction

- Full audit trail with maker/ checker/ approver name and time stamp

- Processing speed and efficiency. Transparency in operations

- Minimize hassle of storage/ retrival/ misplacement

- Hard copies barcoded/ scanned/ archived and converted to digital work items

- Soft documents directly converted to digital work items

- Documents digitized: Invoices, Master Data documents, LCs, BG, Price Lists, Fund Statements, Digital Work-flow and Digital Calendar

- Carries the digital work items across designated path as per Delegation of Authority

- Holds list of maker/ checker/ approver. Holds the calendar of critical activities

- Triggers emails to Approvers and capture their email response back into the workflow

- All ERP transactions carry digital work Item number by which full audit trail is available

- Documents attached to a work item viewable directly from the ERP transaction

- All operations beyond the scan room are free from handling physical documents

- Full traceability of transactions with name and time stamp

- FSSC users can operate from any location. Approvals and responses given through email.

- Auditors get all supporting information directly from the ERP and perform audit remotely

- Outstation locations can send documents to scan room or initiate digital work requests

- Physical document storage much more structured and reduced

- Digital calendar sends reminder and tracks completion of critical time-bound activities

The Finance Shared Service Centre (FSSC) of The Chatterjee Group (TCG) is based at Kolkata, caters to two petrochemical companies viz. Haldia Petrochemicals Ltd (HPL) and MCPI Private Ltd (MCPI), with a combined annual turnover of over Rs 17,000 Crores. Both entities are headquartered in Kolkata with production facilities located at the industrial hub of Haldia, West Bengal. Both are member companies of TCG, having investments and operations spanning several continents and industries. HPL and MCPI are flagship companies of the group in the petrochemical sector.

HPL is a state-of-the-art petrochemical complex, producing various types of polymers and olefins, marketed across India and globally. HPL has been a symbol of industrial resurgence in West Bengal. Through strategic market focus, innovative product application development and excellent customer support services, HPL has played the role of a catalyst in emergence of more than 500 downstream processing industries in West Bengal with a capacity to process more than 1 Mn TPA (Tons Per Annum) of polymers and generating more than 150 thousand employment opportunities in the process. MCPI is a front runner in the manufacture of Purified Terephthalic Acid (PTA) which is the basic raw material for the polyester industry. MCPI has established itself as a trusted supplier to the polyester industry in the country and a leading manufacturer of PTA.

Conceptualizing the FSSC

FSSC was conceptualized in 2017 to try out the shared service model on an experimental basis, starting with F&A. The intention was to make the support functions future-ready, to meet the growth aspirations of the group. For a pure manufacturing entity, this was a novel idea.

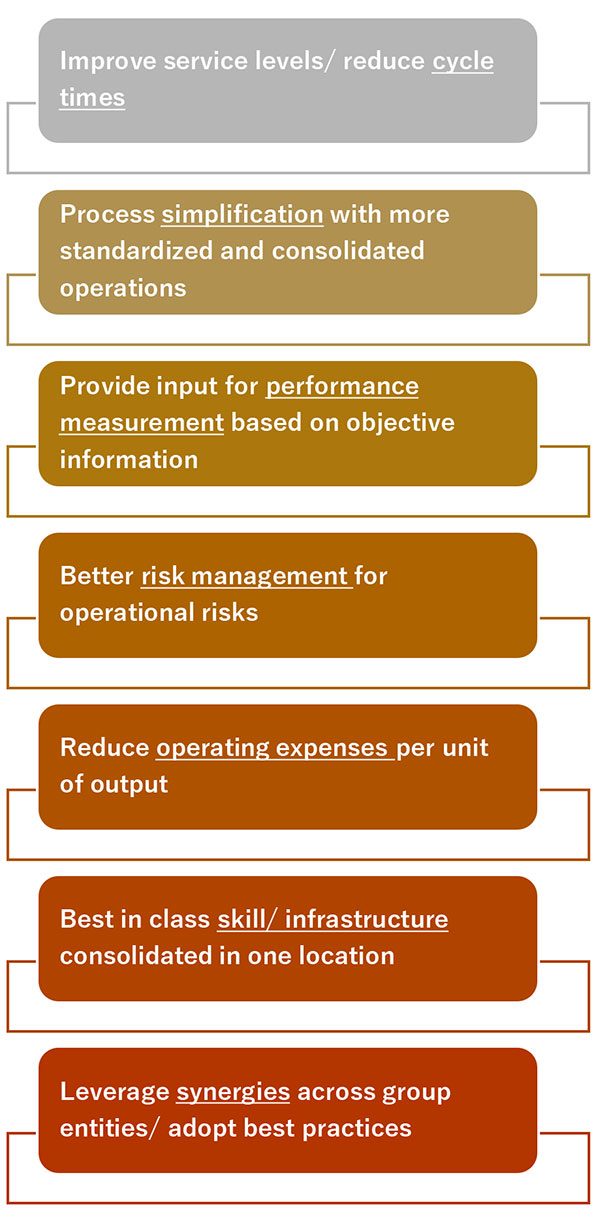

It created ripples in the mind of the accountants – their transactional processes soon to be restructured – leading to concerns as well as excitement. The key objectives envisaged for setting up of the FSSC were:

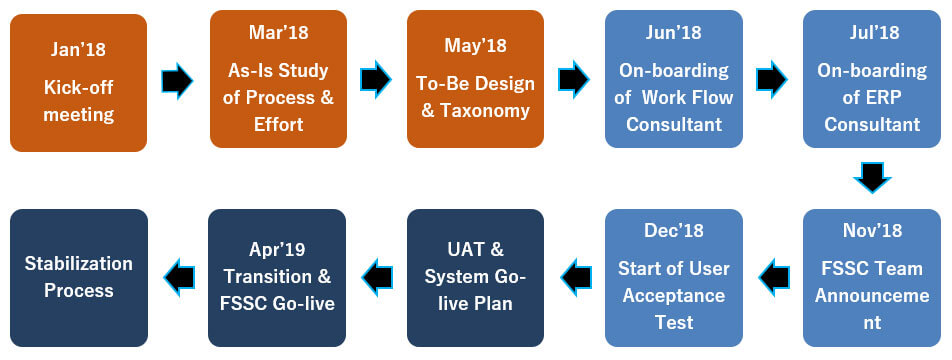

Implementation Road Map

In early 2018 the FSSC implementation process was kick started. One of the Big 4 consulting firm extended consulting support with outside-in analysis of all the transactional processes. Taxonomy of the Finance Function was built to assign responsibilities between the Shared Services and the retained organization.

To-be process designs were built to identify work-flows, digitization needs, internal control aspects and ERP enhancements. Go-live was done in April ‘19. This was preceded by months of hectic interaction and UAT by the FSSC Team, who had to balance their ongoing daily responsibilities along with the new ones. The whole project was managed by TCG Digital, the IT outfit of the group.

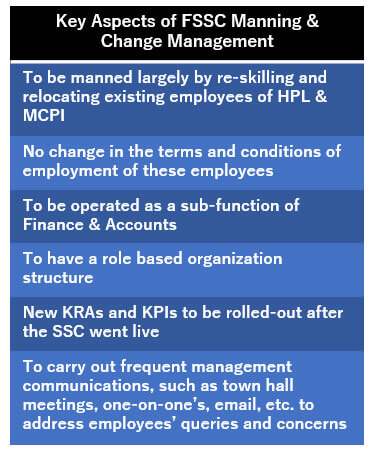

People and Change Management

Transition to the Shared Services setup was driven by common consensus across the divisions. FSSC manning was planned in advance at the initiation stage and many of the key members chosen were involved in the development of the project.

FSSC Structure, Vision and Responsibilities

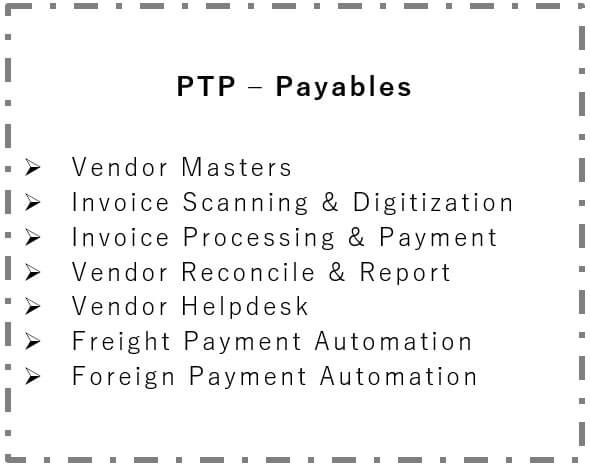

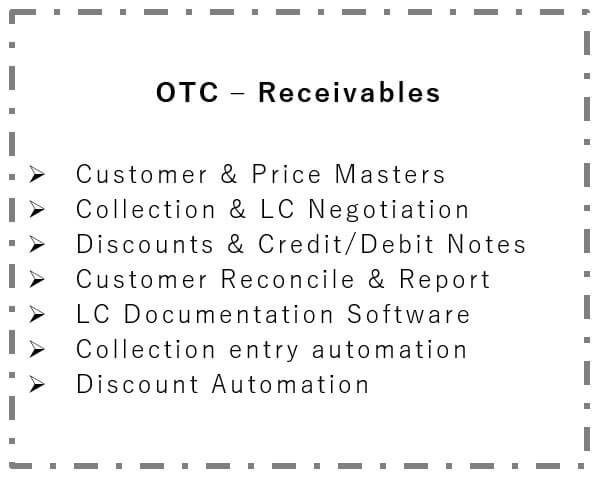

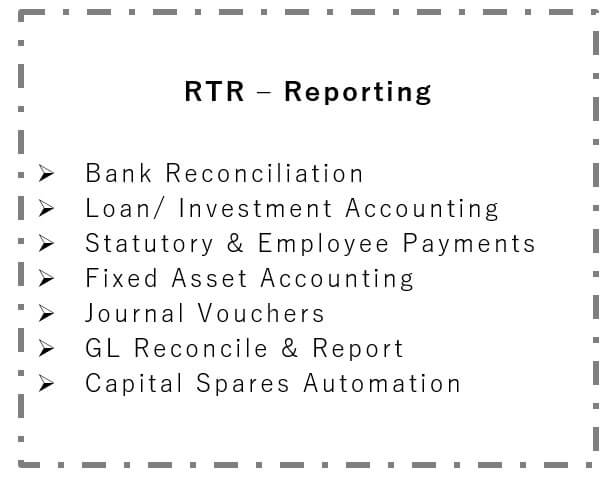

Three service towers viz. Procure to Pay (PTP), Order to Cash (OTC) and Record to Report (RTR) provide services to both the customer companies. As the system matures, the plan is to extend the services to other companies within the group.

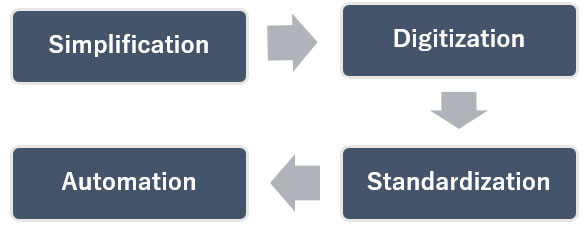

The FSSC organization reports to the Chief Financial Officer of HPL. However, it has been setup as an independent unit within the corporate office at Kolkata. The FSSC team has been built by reassigning and relocating resources from HPL and MCPI. Support function like HR, IT, Admin and Payroll which provides services to the retained organization also extends their services to the FSSC team. The unit has an individual identity with its own goals and mission statement. The mission of the FSSC organization is to achieve its key objectives (as stated above) through –

This also doubles up as the primary metrics of the FSSC Head.

Though largely the customers of FSSC are the retained organization like Marketing, Finance, Procurement and Payroll, it also caters to the needs of external parties, such as banks, external customers, vendors, and auditors. A stake in the ground has been established. The team strives to achieve the following high-level goals as a first step:

1Payment release within 4 days of receipt of a valid invoice

2LC negotiation within 4 days of sales billing

3Reconciliation of all banks within 4 days of month close

4Monthly accounts close and reporting within 10 days of month end

5Zero adverse audit observations on internal financial controls

Processes Shifted to FSSC

Business Outcomes

Implementation of Finance Shared Services has given significant benefits to the organization and has changed the outlook of how deliveries can be made seamlessly within defined timelines and accuracy.

Benefits like reducing the processing cycle of transactions, digitization of documents, consistency in delivery quality, automation of collections accounting and incentive computation have improved the way the organization operates.

Economies of scale and standardization of processes across the entity helps optimize cost of Finance support functions and improves working capital management.

The Covid-19 situation resulted in a complete lockdown of the country. The FSSC team operated digitally from home and this was the time when the organization could realize the benefits of FSSC more than ever before. Since the processes were standardized, digital workflows and digitized documents made it possible for work to be done flawlessly without any significant disruption. The new normal gave the platform for the team to perform and exceed management expectation.

1Timely and Accurate Vendor Payments

Vendor payments impact our relationship with the business partners and gives confidence and bargaining power to our Procurement team.

User Expectations

VENDORS

PROCUREMENT

ACCOUNTS & AUDIT

MANAGEMENT

Change Management Undertaken

Value Delivered

2Automating Sales Collection and Credit Control

Timely accounting of sales collection greatly impacts our cash flow and helps in managing customer credit risk.

End User Expectations

TREASURY

MARKETING

ACCOUNTS & AUDIT

MANAGEMENT

Change Management Undertaken

HOST-TO-HOST

LC SOFTWARE

CREDIT CHECK

Value Delivered

3Digital Transformation

Digitization has been an integral part of our FSSC journey. It has brought speed and transparency in the processes. It kept the FSSC operational during Covid and Work-From-Home days.

End User Expectations

FSSC USERS

OTHER FUNCTIONS

AUDIT & STATUTORY

MANAGEMENT

Change Management Undertaken

SCAN ROOM

WORKFLOW TOOL

ERP CHANGES

Value Delivered

Lessons Learned

1Business process changes are slow and painful but essential for success.

2Change has to cut across departmental boundaries and cannot happen in silos.

3It is better to implement a change in one go. One cannot cross an abyss in two steps.

Way Forward

Currently the organization is right in the middle of its learning curve. The processes implemented under FSSC are expected to fully stabilize soon. Improvisation stage would start thereafter. In the days to come, the team would strive for better performance and be ready to cover other entities of the group.

The objective of FSSC is to serve more companies in the group and transform it from a cost center to a revenue center.

Shared services is a continuous improvement journey. Robotics Process Automation (RPA) and Artificial Intelligence (AI) are areas to be explored for implementation, to improve efficiency and reduce human error rate. Setting up a Center of Excellence (CoE) to develop a global service delivery capability is also on the cards.

ABOUT THE AUTHOR

Avijit is an ICMA & MBA (Finance). He has been in the Finance profession for 30+ years with a mix of industry-cum-consulting experience in Performance Management, Business Finance and Financial Control. He started his career with Aditya Birla Nuvo and his experience spans across multiple manufacturing industries like Textiles, Metals, Chemicals, Petrochemicals. He has been instrumental in setting up ERP driven business process for green field ventures.

Over the years he has provided functional leadership in upgrading the FP&A systems of organizations. In his previous assignment as Principal Consultant and Senior Domain Expert (Finance) in TCS, he has lead consulting engagements in performance management for various industries.

Presently he is the Senior General Manager – Finance at Haldia Petrochemicals Ltd. Apart from being the FSSC – Head, he also leads the Business Finance, Costing, Budgeting, MIS activities and plays an active role in P&L management of the organization.

The article has been authored by Avijit Kundu with Insights from the Tower Heads – Sanjay G Jha, Arunabha Biswas and Abhik K Bose.