Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowThe shared services model has come a long way in the last three decades. While it started in India as a pure play cost arbitrage program, it has now evolved a robust, fully integrated suite of offerings, providing actionable business insights and by being a trusted advisor and a valued consultant.

The industry journey initially began with three broad verticals – transaction processing, voice, and accounting services. Since it was a green-field industry and in many aspects, evolving based on the “tone from top” principle, most providers had varied experiences to offer. Based on their breadth and depth of the sponsorships, there were some leaders and some laggards. As it is very well documented now, AMEX and GE were clearly the leaders and many organizations followed in quick succession.

In India, talent availability was never an issue. However, other infrastructural challenges were – uninterrupted power, connectivity, transportation of employees, night/holiday working, etc. All of these were very critical as many activities were done during India afternoon/ evening/ night-time. The country has indeed come a long way now – the power situation has become quite stable; radio/MF wave-based internet connectivity has given way to one of the world’s most reliable and cheapest broadband; transportation fleet has become wide and professional; and laws around 24/7 working and safety are in place. The government played a stellar role in nurturing the industry. Vast infrastructures got created in support – SEZs, tax breaks, and laws around pricing/ charge-outs. The industry continues to be a huge exporter of services and a mammoth job creator, not just in Tier 1 cities but right up to Tier 5 cities.

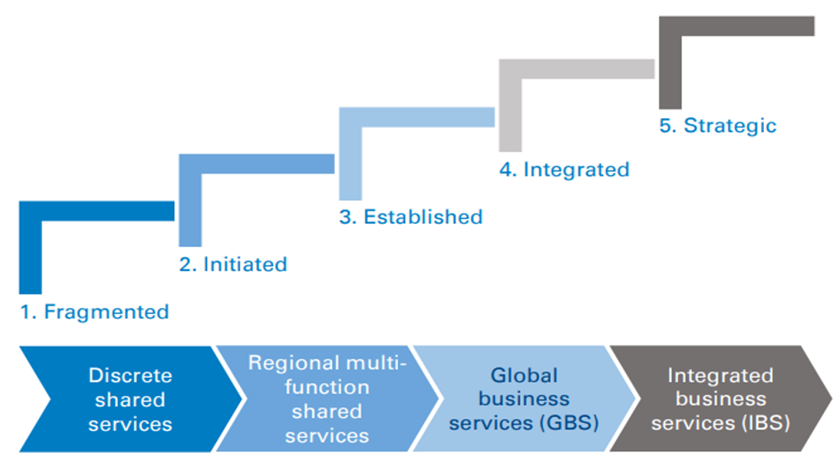

In the late nineties, visionary leaders from these two organizations became entrepreneurial, and that too was a paradigm shift. They had the ability to foresee the possibilities of offering end-to-end services and not be waterlogged into tight silos. Slowly they started creating organizations that became game changers. The evolution of the industry into what it is today is generally thought of as a 5-step process, depicted below:

Today, the shared service centers are state-of-the-art units, deploying cutting edge practices in all aspects - people, processes and technology. SSCs have, in fact, become business process engineering centers continuously adding value.

To remain at the top of the game and to move forward, there is a need to establish two critical components upfront: a strong leadership capable of taking independent, courageous decisions; and a clear vision, much beyond service.

The key is using technology to not only ESA (Eliminate, Simplify and Automate) but to gain and share insights and help the business grow. It is important to continuously “up” the game to remain ever meaningful. The business canvas may be very wide. The center will do well by establishing differentiated strategies for each broad service offering, and understand their inter-linkages, both upstream and downstream to get insights and give solutions.

Becoming an “Insights” Center

As the industry matures, the art to keeping the ship afloat in the most efficient manner should lead into steering the same in the right direction. An established new-age service center is best poised to not just limit itself with a stereotyped image or a narrative, which has somehow been built over the years. SSCs can, in fact, become the providers of the most precious ingredient for the enterprise – business insights.

The key success factors for moving from being a pure play SCC towards a new-age insights center are:

1Industry and functional/ domain knowledge

It is imperative to understand and master the product industry of the client/ principal – its drivers as well the SWOT of all the major players in that industry – to be able to add real value. Domain knowledge, industry developments, and tracking the competition is very important – as is the need to be updated on the continuously changing landscape, especially the role of technology.

2Metrics for synergy identification & automation of all repetitive tasks

A professionally run shared service center should develop traceable metrics for everything important – and keep them continuously evolving to best suit the need and circumstances. Practices in accurate and deep data mining from these metrics and comparing efficiency in one’s own organization to others has provided many compelling cases for change over the years. Secondly, digitizing the workflow upfront and then automating it from the root for all repetitive tasks is the best way forward. RPA or better still, BPA, works best if developed together as one synergized process.

3Accelerated consolidation across product offerings

An efficient shared services organization should lend itself to a natural consolidation point for all processes under Finance, IT, Administration, Procurement, HR, Program/ Project Management, Legal, Customer Service, Back Office and other functions. Detailed value stream mapping of the current activities accompanied by shadowing and reverse-shadowing interchange between the shared services and incumbent staff can result in rapid learning and job knowledge transfer. Absorption of such functions into the organization-wide, one-common shared services center can rapidly bring synergies in a decentralized or a diversified functional organization structured by divisions or business units. This is in stark contrast to de-duplication efforts in organizations that have no precedent or shared services capability, who will typically take far longer to complete this process effectively.

4Real time, on-demand business insights

With access to all the deep domain data from finance, customer service, competitor analysis, industry developments, and global macro-economic trends, the center should look into the pain areas of the business and provide real and actionable solutions. Although metrics give excellent indications of the pain areas, the real understanding comes from conversations with the business leaders. A strong amalgam of relationship, an outside-in approach and acute business sense can help provide strategies that could prove critical to enterprise. IT systems, especially the business reporting systems can play a big role in this.

5Highlight potential risks and mitigate them

By keeping an overall enterprise wide approach, the center can provide the best solutions towards identifying and mitigating risks - both operational and financial. Usually a shared service center will be created with experienced staff from diverse backgrounds on the team. And they have the domain and industry knowledge. This brings considerable experience to the table – to be able to identify and mitigate all risks. These “old foxes” can prove to be very valuable as they have several previous learnings that helps in fastidious planning that encompasses all stakeholders, especially on the IT and cyber security side. This includes detailed coverage of the assessment of risks, changes required i.e. mitigation; associated communications and arrangements regarding continuous monitoring.

For the SSCs to succeed, they must ensure adherence to all the above key success factors to create a fair, robust and transparent basis for selection of internal best practices. Salient differences in performance highlights areas requiring more detailed comparative analysis. It creates transparency around how and why one organization’s practices come to be considered more efficient than others. The transparency of this approach also helps to neutralize political maneuvering, change management and rhetoric that influences decision making in these situations and results in a deep appreciation of why one process or structure outperforms another, in the given circumstance. It is a Darwinian selection process which ensures that the fittest processes survive. Impartial selection and implementation of the best solution builds belief in a ‘best of all’ culture which recognizes and acknowledges the relative strengths and contributions of the respective organizations.

Skilling for Success

Leadership and team management play important roles in the running of an enterprise. When operating on the cutting edge of specialization, this becomes all the more so. For moving towards being an Insight Center, people will need new skills to create the right strategies and evolve:

- Ensure “right skilling” – The shared services industry has traditionally been hiring overqualified staff, which has had its own issues. The leadership should assess the right skill required for the job and hire only the right-fit candidates. Both over and under qualified staff are likely to compromise the quality of the service in the long run. Soft skills are equally important to keep in mind. Staff members who are constantly evolving and willing to learn, unlearn and relearn - again and again can be worth their weight in gold.

Agility is another factor, which has gained currency in the march forward. Things are unlikely to work unless the staff involved is sharp and willing to quickly change tactics with the changing environment.

- Big vision – As in all professions, specialization is important. However, it is equally important to never lose sight of the big picture. Unfortunately, many SSC workers fail to appreciate the need to develop their ability to understand the inter-linkages between the different parts of the business, and their impact, both upstream and downstream. Companies appreciate a service provider whose insights are forward thinking, not just reporting and processing backward-looking/ past data.

- Technology savvy – Having a technology savvy workforce is a major skill, which is indispensable. The lines between IT and operations are getting blurred and the ability to use technology as an enabler is a huge differentiator. Whether it is to simply automate or use it to get various cuts of data, technology is the only savior. The ability to embrace technology a “co worker” is the prime need of the hour.

- Collaborator and influencer – All employees need to be effective communicators, able to collaborate with, and influence internal as well as external stakeholders. For instance, while respecting and encouraging diverse views, the modern accountant must be able to build consensus. In the past, communication was not a skill expected from all employees – just from the leaders. However now, if they are to be valued advisers, all employees must not only be able to communicate but also to influence. It is a two-way street in which the accountant’s contribution is far more than merely number crunching.

- Emotional insight – In today’s world of artificial intelligence, emotional intelligence is a key skill for challenging existing business paradigms. While many rely on AI to identify trends and predict the future, nothing beats the human mind for perception. The inherent skills of common sense, judgment and conviction still count at the highest merit.

- Integrity – All SSCs have access to sensitive data and many times are authorized for conducting financial transactions. The center carries a position of trust. There have been instances, the world over, where this trust has been broken and the corporate brand been blemished. Intentional misappropriation of assets, data or information can cause serious damage and may result in a significant competitive disadvantage. Additionally, “creative” or disguised reporting, whether intentional or unintentional, can also weaken the system. A position of trust is built over a long time and with tremendous effort. This is a skill that should be encouraged and appreciated the most.

A Real-Life Example

“A trend is your best friend”, and who better than an integrated SCC to catch it. Since almost all shared service centers generate humungous amounts of data, they have evolved into becoming consulting centers. Here is an example of how a remote shared service and sales/service call center not only does its business of providing quotes, booking orders, etc. but also the uses the data generated from this exercise to provide high quality actionable analytics, generate more revenue, and be a partner of choice to the business.

The process: an order to cash cycle – a typical voice, transaction processing and finance back room center’s role.

Core activities:

- Based on an inward inquiry (e-mail or voice), provide first quote with pricing, including discounts, if any

- Subsequent quotes pricing (e-mail or voice) and, depending on the product, being put in touch with a sales executive

- Credit check of the customer and past payment analysis

- Booking of orders received

- Generation of mails and digital copy of the contract

- Intimation to the manufacturing/ order fulfillment centers

- Monitoring of goods dispatched, services rendered, revenue booking, AR logging, and Inter-company invoice booking

- Follow-up and collection of AR dues

Actionable analytics carried out:

- Percentage conversion and TAT of the formal order - based on several data models, such as first-time/ repeat/ strategic customer

- Customer behavioral trends – month end/ quarter end/ random; blanket vs defined; time taken form the first quote to PO date; past order details of same product(s) and ordering trend, etc.

- Farming vs Hunting analysis - Demand patterns across product lines and customer types, including cross-sell and value-add products to the customer

- Discounts offered in the quotes, trends and percentage conversion

- Average discounts across the product lines, weight average discount charts based on performance and volume commitments

- Expected gross margin shifts, by products and product lines based on the first quote and final order

- Inventory tracking on the product sold, prediction of consumables replenishment and service due

- Warranty period expiry/ paid service begin reports

- Annual contracts revision reports

- Potential growth models with incentive structure and what-if scenarios

- Volumes ordered tracking against the contracted value in “pay for use” contracts to ensure validity of differential pricing

Upon Reflection

There are numerous examples of companies which started off as simple SSCs but have evolved into full-fledged and respected internal consulting centers, not just in India but worldwide. And that is where the future is – a natural evolution of any industry/profession. A tectonic shift is taking place – B2B and B2C space is converging and we need to adapt to this trend by being nimble and fast paced while serving the end customer. Digitization, automation and data mining helped the SSCs a great deal. It is imperative that the SSC leaders stay focused on that path and make sure to add value to the business.

No longer should such centers see themselves as shared services organizations, but as end-to-end knowledge hubs and providers of astute business insights – its rightful place being at the corporate decision-making table. Maybe it is time to rename the industry.

After all the name is a description of what one is and depicts the mindset.

ABOUT THE AUTHOR

Sameer is Director – Finance at Agilent Technologies. Agilent Technologies is a NYSE listed life sciences and a biotechnology company based in Santa Clara, USA. It’s centre for worldwide back office operations was established in 2002 and is based in Manesar, India. It has since evolved as a center of excellence across the lines of operations. It handles transaction processing, finance and accounting and voice processes and prides itself in being a leading player offering valuable insights.

He is a qualified Chartered Accountant (CA), Certified Public Accountant (CPA -USA) and a Cost & Works Accountant (CWA) and his areas of expertise lie in record to report (R2R), financial planning and analysis (FP&A), procure to pay (P2P) and quote to cash (Q2C). Sameer has worked in many countries, is a big advocate of leveraging technology for finance and feels benchmarking of financials is the best way of improving and driving cost efficiencies. Prior to the ~ 14 years with Agilent, he has worked with companies like GECIS/Genpact and PwC.