Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowIn recent times, leading global banks have drawn attention towards trading patterns where an individual employee has the ability of putting the financial position of the banks or trading houses at risk. This is commonly referred to as Rogue Trading. Rogue trading has largely been possible due to limited awareness towards risk-based scenarios and vulnerable organization practices, paving an easy way towards such outcomes. With likelihood of cybercrime and ransomware, there is a huge risk involved where any single act of such practice can convert the capitalization of any bank or financial institution to a significantly low level and impose existential threats in terms of direct financial exposure,loss of customer base or huge penalties.

He brought down the 233 year old Barings Bank to a third of its capitalization. Incurring losses of US$1.3 billion from unauthorized investments in index futures contracts were sufficient to bankrupt this centuries old financial institution in 1995.

The risk of rogue trading can be effectively mitigated early on by warning signals flagged off by AI based cognitive RPA that helps to prevent occurrence of such scenarios from the system.

The table below specifies the top financial losses which were caused directly by rogue trading between the period 1992 and 2011.

The case of Nick Leeson requires special mention which led to Baring Bank’s eventual insolvency. He brought down the 233 year old Barings Bank to a third of its capitalization. Its losses on unauthorized investments in index futures contracts were sufficient to bankrupt the bank in 1995. Through a combination of poor judgement on his part, increasingly large initial profits, lack of oversight by the management, a naïve regulatory environment, and an unforeseen outside event - the Kobe earthquake,Leeson incurred a US$1.3 billion loss that bankrupted the centuries old financial institution.

Risk of Rogue Trading

In the world of data protection accountability with mandatory compliance of GDPR like regulations, organizations are more vulnerable to unauthorized access from inside, than external data breaches.

Rogue trading is one such scenario which is high stake and prone to high risk, high tension and high frequency. The operational dangers inherent in the world of securities and derivatives trading have risen dramatically in last 20 years with operations becoming digital.

This new threat is a result of the advent of high-frequency, ‘black box’ trading strategies, which are fully automated but not fully optimized, for the low latency exchange markets. In the past, traders would exceed limits, and finding prices moving against them, extend their unauthorized positions. The build-up of risk and losses would force the individuals to cover up and misrepresent activities. Such hidden positions, when brought to light, have toppled banks, and led to resignations of senior executives with otherwise stellar records. In the future, banks, or worse — clearing houses — could be brought down by high-frequency trading software building massive positions in unforeseen and difficult to predict ways.

The black box rogue trading scandal of the future will have much in common with the rogue trader scandals of the past. The actions of those individuals dubbed as ‘rogue traders’ have fascinated and, to an extent, invoked a degree of awe and admiration from those not directly affected by their machinations. These individuals’ circumvented controls, exceeded limits, and carried on by misrepresenting their holdings and risk.

...hidden positions, when brought to light, have toppled banks, and led to resignations of senior executives with otherwise stellar records.

Unfortunately, in the high-stakes, high-risk, high- tension world in which traders find themselves, the drive for success can overcome ethics. These individuals cover losses and deceive their colleagues, often in clever and ingenious ways. After the blow-up, it usually turns out that rogue traders have exploited multiple weaknesses in their firms’ procedures and systems. Keep in mind as well, that in most cases, investigations reveal that a number of managers were aware of the profits (which later, of course, turn out to be fictitious), and therefore the risks that were being taken.

Key Questions for Risk Management

In the digital ecosystem, there are many automated activities, which require regular reviews and governance to reduce risk exposure. Some of the important questions to be asked are listed below:

- Are banks running ‘stress tests’ on their high frequency trading programs?

- Could errors in price feeds from the many sources of market data trigger a flood of trades before the aberration is detected?

- Could detailed knowledge of a large bank’s algo trading rules be exploited by an external trader who sets off the market conditions that lead the algo to ‘misbehave’ or ’go rogue’?

- Are regulatory cross-market ‘circuit breakers’ and trading halts required, or can natural price discovery be retained in today’s low-latency markets?

Concerns around the role of these algorithms skyrocketed after the so-called ‘flash crash’ of 6th May 2010 that caused the Dow Jones Industrial Average to plunge nearly 1,000 points in less than a half hour, with nearly a trillion dollars in stock market value evaporating — and then (mysteriously) reappearing. When it was later discovered that 68 per cent of the questionable trades that ended up being cancelled involved Exchange-Traded Funds (ETFs), whose trading is highly computerized, the US regulators decided to explore whether algorithms that cause disruption in markets should be treated as if they were rogue traders.

Regulators are eager to develop methods for assigning responsibility when trading technology goes awry. Overall, the computerization of financial markets has improved transparency and efficiency, and reduced investors’ costs. To avoid politically motivated bans on new trading technologies, leaders in the financial markets industry must define when high-frequency or algorithmic trading crosses the line into being disruptive to markets, and who is responsible when it happens. Finding the answers to these concerns is now perhaps the most critical element in ensuring the safety of financial systems in the future.

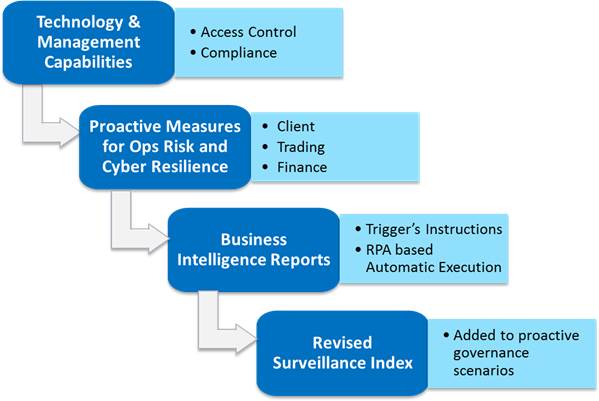

With a two-pronged approach of system audit and monitoring transactional data, AI-based cognitive RPA solutions via predictive model and proactive actions not only provide early warnings but also execute them automatically. The key benefits for the organization by installing such solutions are:

✓Stakeholder Value

✓Corporate Governance

✓Risk and Compliance

✓Early Warning Signals

✓Prevention of Financial loss

✓System

✓Robustness

Digital Capability for Risk Management

As per current circumstances, Blockchain, IoT and RPA are taking over human input based governance. There is very little room left in the process or system not monitored closely in an integrated architecture. To have such a robust capability, organizations need to have a clear view of not only their enterprise architecture i.e. SOA (Service Oriented Architecture) but also customer facing BPM platforms. There is a distinct possibility that agile enterprise changes may leave some risk controls open for future vulnerabilities. In light of such situations, AI-based capability is not only vital but imperative to have.

Business integration services are putting a ‘method in the madness’ by framing agreements for their partners and vendors. However, a huge area in operational environment is left unattended. In the digital world, old methods/ practices are not going to be replicated. With disruptive technologies and dynamic business environment, structured thinking based on concepts and lots of imagination is required to seek the necessary capability to meet internal and external threats and attacks.

Case Scenario

Recently, a leading BPO company conducted a risk assessment exercise of many of its clients to identify vulnerable scenarios at client locations. Based on the learning captured, an AI-based solution was designed to mitigate all such scenarios in the future. While assessing the Trade to Settlement process on a client, the BPO Company observed that there are huge discrepancies in the system with respect to people, processes and technology. Based on preliminary suggestions, the client noted the hugely vulnerable circumstances of their processes the client decided to leverage the assessment to not only determine the loopholes but at the same time, take immediate preventive and corrective actions.

AI Based Deep Learning Framework

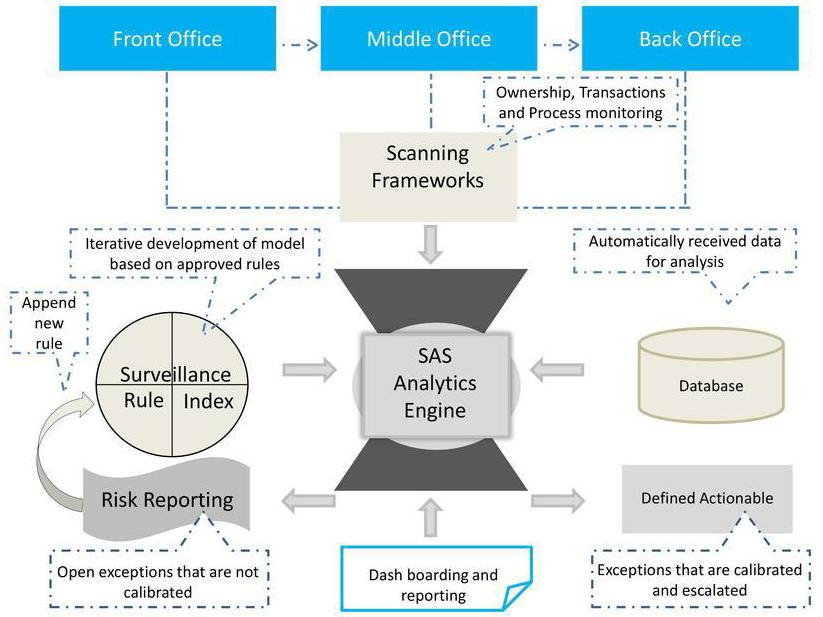

Based on various scenarios, a pattern discovery analysis has been designed through multivariate and big data analytics that will identify the drivers (independent factors) of such instances and frame a predictive model for early warning signals and establish robustness of the system.

The key areas where the below methodology helped are:

✓Access Control Issues

✓Technology Implementation in mapping business rules to accounting books

✓Reconciliation Issues with respect to open exceptions

✓No ownership and accountability against failed trades

✓Discrepancy in Static and Reference Data

AI-Based Surveillance Mechanism

1. Core Process Based Scenario Governance;and

2. Data Driven Discrepancies

Both these dimensions are elaborated below:

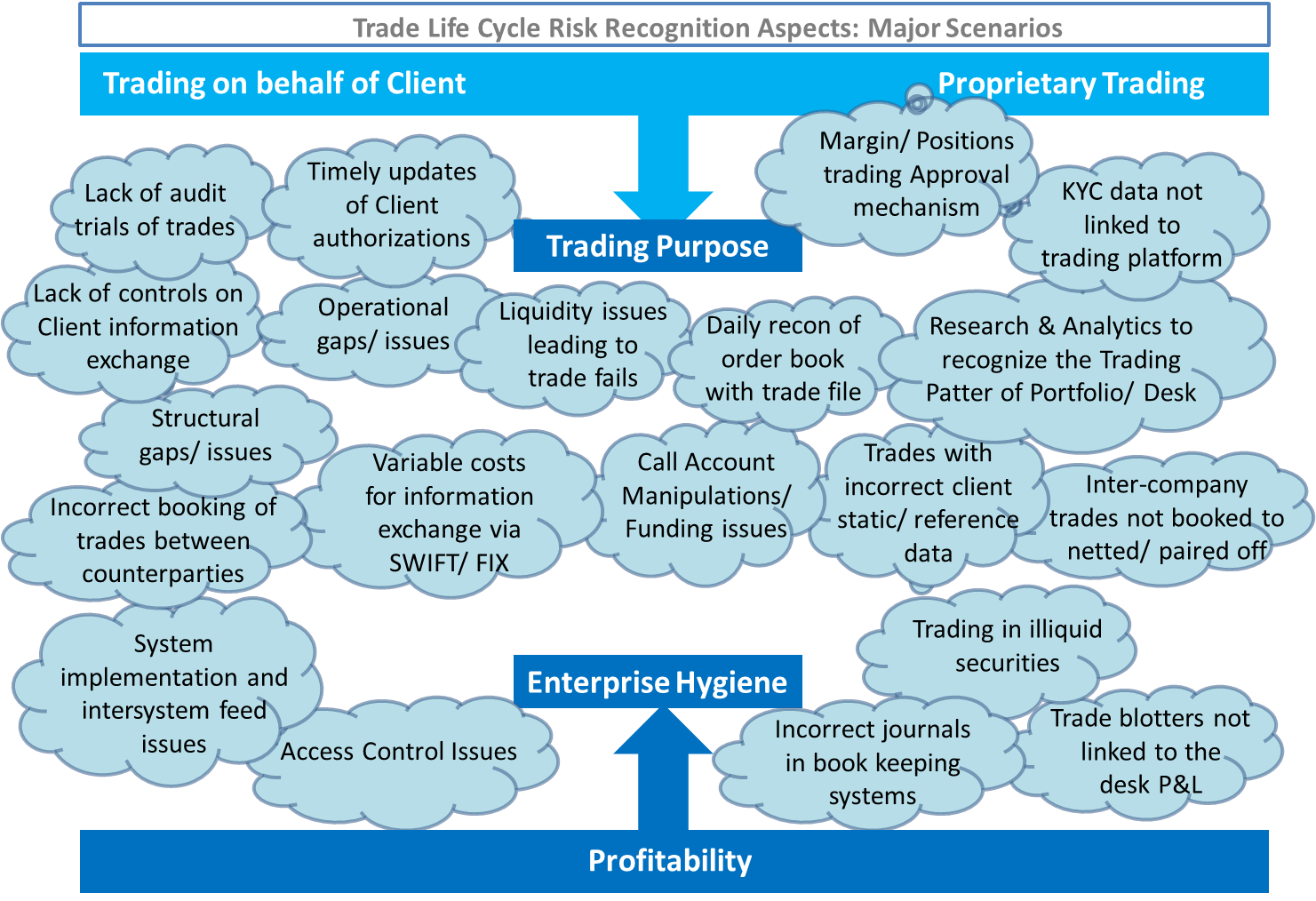

Core Process Based Scenario Governance (or System Audit Framework & Business Intelligence). Here, user stories and remedial actions need to be configured on the AI platforms as scenarios to put a robust and scalable governance mechanism in place. The process and customer journey scenarios can be broadly classified into two categories:

- Trading related scenarios where transaction level governance is required, and

- Enterprise security and hygiene, which requires significant specific security standards and framework based approach for sustained and consistent operational excellence.

The two categories as above have their own specific elements but it is very essential to note that these two categories are interdependent, making the scenario complex, demanding digital capability to track and monitor risks from rogue trading.

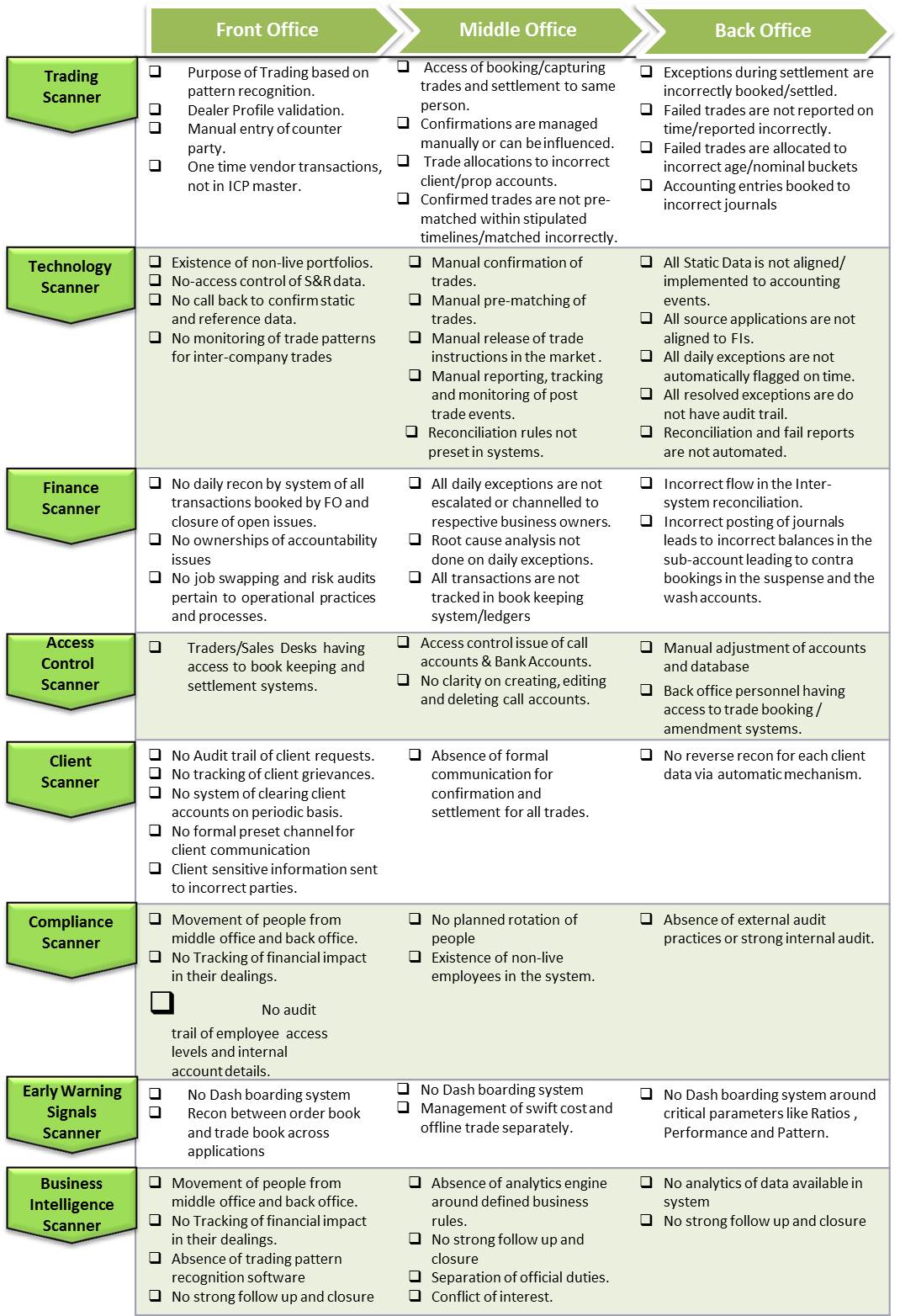

In the next table, details of the major factors are mentioned, in terms of developing scenarios and incorporating controls in front, middle and back office.

Data Driven Discrepancies (or Data Driven Actionable Insights): These are descriptive, diagnostic, predictive and prescriptive analytics via actionable insights, KPI reports and models/patterns.

Core Preventive Measures

The major rogue trading cases discussed above were all avoidable through basic, general management governance and review. There are a few immutable principles in the control of trading operations, but management must enforce them rigorously and continuously with no exceptions. The four core principles for avoiding rogue trading disasters are as follows:

- Separating front/middle/back office activities and processes. Segregation of duties ensures traders cannot interfere with the processing and reporting of their transactions

- Limiting access to trading, risk control and settlement systems to separate functional areas completely and preventing any individual from having access to more than one area

- Using independent, outside pricing sources for mark-to-market valuing of positions. It’s easy to value a bank’s position in IBM shares, but many traded instruments do not have an easily obtainable market price. Allowing internal staff to enter price estimates for profit and loss calculations opens the firm to deception

- Ensuring integrity, which is the key to a good trading system. This means all trade accounting data are accurate and consistent, and can be verified easily through reconciliation with external parties (e.g., client trade confirmations, clearing, etc.)

In summary, firms must maintain a robust control environment, allow for audits, limit access to key functions to specified users, and be able to reconcile with other internal and external data.

Way Forward for Digital Readiness

The AI based surveillance mechanism and framework leverages all the digital capabilities of the organization and offers a robust and scalable framework where data-driven and culture building practices provide a holistic environment that leads to a secure framework and mitigates operational risk, especially led by rogue trading and other off trading practices. Putting a structured framework works as a significantly effective deterrent against ongoing cyber and internal attacks and compromising positions for the organizations. Since this is a dynamic and never ending process, it is essential that organizations should align dedicated teams on research and analysis of other possible scenarios and enrich surveillance index organically and inorganically. There is also a need to view actions taken by RPA- led engine and review the performance in pre and post implementation conditions. Assessment of risk requires innovative ways of measuring risk - be it interviews, suggestion system, floor governance and secondary data inputs which is from the qualitative point of view and not covered in the present way of working. Big data based analysis covering both unstructured and structured data offers intelligent monitoring of transactions and defined process which provide an opportunity to install early warning signals, lead indicators, caveats, advisories to seek vulnerable tendencies. Benchmarking and digital performance management standards too need to be developed in this space, which may also prove useful in leveraging digital capability for business performance.

ABOUT THE AUTHOR

Neeraj Parashar is Practice Head of BFS, Global Risk & Compliance, Digital and Design Lab for Tech Mahindra, and has also worked as Global DPO for TechM. He is pursuing PhD in Digital Transformation (where he has written digital performance management standards), and MBA (Information Systems and Marketing) from IMS, Indore, M.Phil in Economics, Certified DPO, Six Sigma MBB, Lean Master, PMP, CIO Said-Garter Certified Professional and an alumnus (Diploma in Software Engineering) of Carnegie University of Pittsburgh, USA. With over 18 years of experience in consulting (operational, architecture and advisory) and managing delivery of Digital and RPA based organization excellence projects i.e. focusing IT and business outcomes especially in the domains of telecom, banking, financial services and insurance. He has managed client engagements in RSA, Singapore, India, UK, EU and US. The solutions developed by Neeraj have benefited customers not only in seeking financial impacts but also in effectively deploying digital business strategic capabilities.