Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowOver the years, Shared Services have gained significant footprint extending their coverage globally. Whilst, cost arbitrage seems to be an evident advantage to firms, aggregation of services/ processes provides a unique vantage point to Shared Services facilitating transition from a service provider to a value proponent. As far as value is concerned, Shared Services have the scale to standardize, load balance, automate, reengineer and gather intelligence/ insights which could aid superior decision making, resulting in lowering cost, The gestation period for delivering results is of paramount importance given evolving environmental (internal as well as external) construct. Considering, we are in a time, wherein shrinking spreads and diminishing revenue lay significant impetus on cost reduction, there is scope for Shared Services, which may not directly drive revenue, to identify opportunities which could provide a unique competitive advantage to both, Shared Services as well as the Organization.

The Game Changers

The game changers which will pave way for Shared Services to attain this objective are Technology and Analytics. Both these areas will play a pivotal role is changing the landscape of offerings within Shared Services. It is important that these are viewed as strategic tools instead of direct threats jeopardizing the Shared Services model. Embracing technology and analytics will open a window to the outside world, extending the ability of Shared Services to leverage insights and also better manage the “unknown”. Whilst it is natural for Shared Services to primarily focus on productivity and efficiency, leveraging technology and analytics to manage risk will prove to be the cornerstone for growth.

…Shared Services have the scale to standardize, load balance,

automate, reengineer and gather intelligence/ insights which

could aid superior decision making, resulting in lowering cost,

augmenting revenue or mitigating risk.

Leveraging Technology

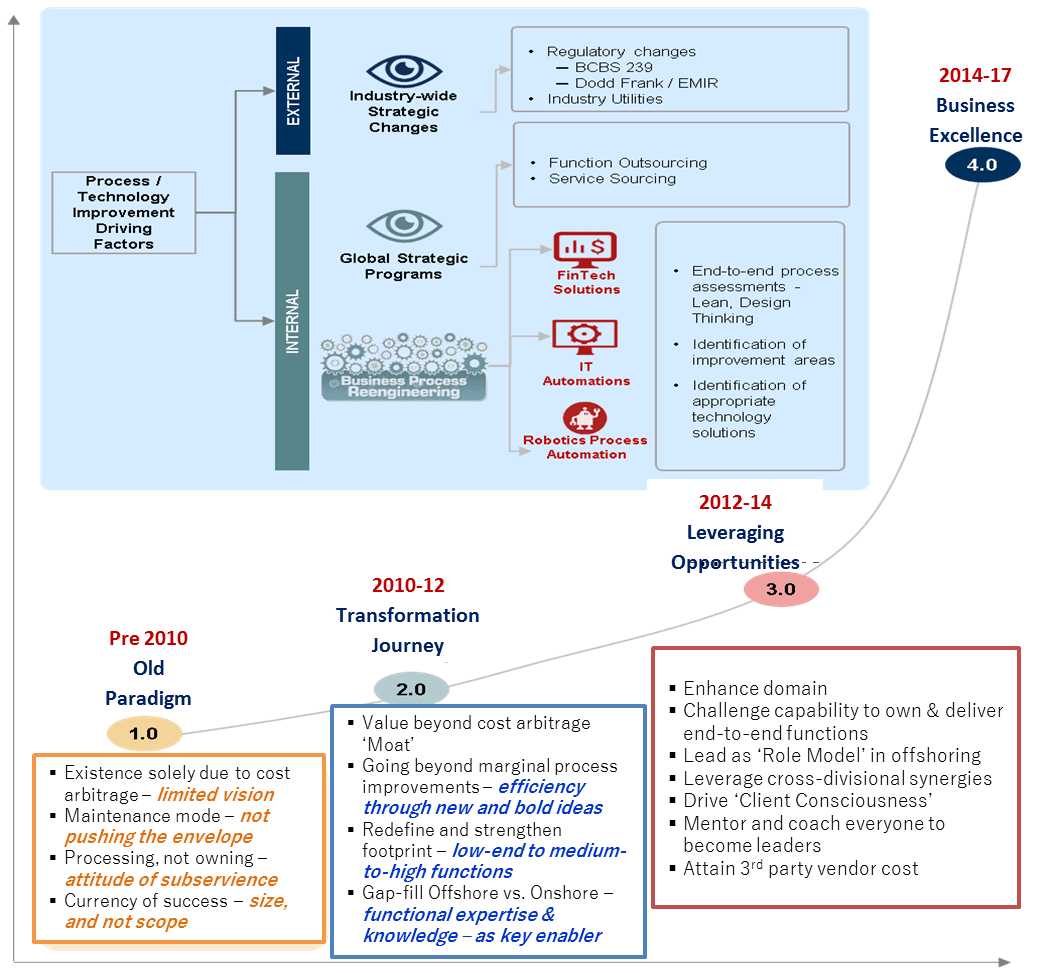

Shared Services journey for the Investment Banking Industry, in the last 10 years has been possible by embracing technology that helped in the tectonic shift from cost to value arbitrage.

Shared Services 1.0: The birth of Shared Services, as we all know, was primarily for cost arbitrage. Investment Banking was ‘terra incognita’ for most who joined the Shared Services. The initial phase of the journey involved ‘doer’ mode of working following the steps of basic processes in which teams were trained on. The vision of potential and opportunities was not developed.

Shared Services 2.0: In 2010, these Shared Services embarked upon a transformation journey to leverage the full potential of the resource pool and deliver value beyond cost arbitrage. A strong partnership with IT was established for comprehensive, end-to-end understanding of the functions (process + technology) migrated to Shared Services. This initiative was very fruitful as it helped the employees in Shared Services and IT to understand the domain better and pushed them to think beyond steps of the processes they were trained on. This helped in improving the confidence of the teams tremendously and the idea of making ‘mundane/ zombie’ work redundant through technology caught like wildfire. Teams came up with many ideas of quick automation through macros, automation of manual recs and elimination of dual keying of data in multiple systems and many more. More than 20% efficiency saves were delivered over two years through hundreds of process improvements ideas with most ideas resulting into fractional staff savings.

A comprehensive Business Process Reengineering (BPR)

approach is now being used along with concepts like Design

Thinking and Lean to reassess end-to-end processes in light of

the changing landscape and identify areas where new

Fintech technology solutions could be leveraged.

Shared Services 3.0: Strong momentum built during the transformation phase was carried forward to take Shared Services to the next level. Capacity created through reduction of mundane work was utilized to up skill and expand the capability of teams to fully own the end-to-end functions. As a result, many global hubs like Reconciliations, Reference Data, Settlements and Confirmations got established in the Shared Service. Shift of critical mass of functions to Shared Services led to IT side of work also move to offshore set up. This resulted in creation of strong ecosystem to further increase efficiencies through scale optimization, globalization & standardization and technology leverage.

Shared Services 4.0: Technology and Regulatory landscape started changing rapidly after 2014. Number of regulatory requirements like BCBS 239, T2S, DF, EMIR, CFTC, to name a few, started leading to both tactical and strategic technology changes. Many industry/ techno-functional utilities in areas of Settlements, KYC, Product Data, Reconciliations etc. also emerged that opened new avenues to leverage latest technology available outside the firm.

A comprehensive Business Process Reengineering (BPR) approach is now being used along with concepts like Design Thinking and Lean to reassess end-to-end processes in light of the changing landscape and identify areas where new Fintech technology solutions could be leveraged. Robotics Process Automation (RPA) is also being used as a tactical fix for repetitive manual steps of the processes.

Leveraging Analytics

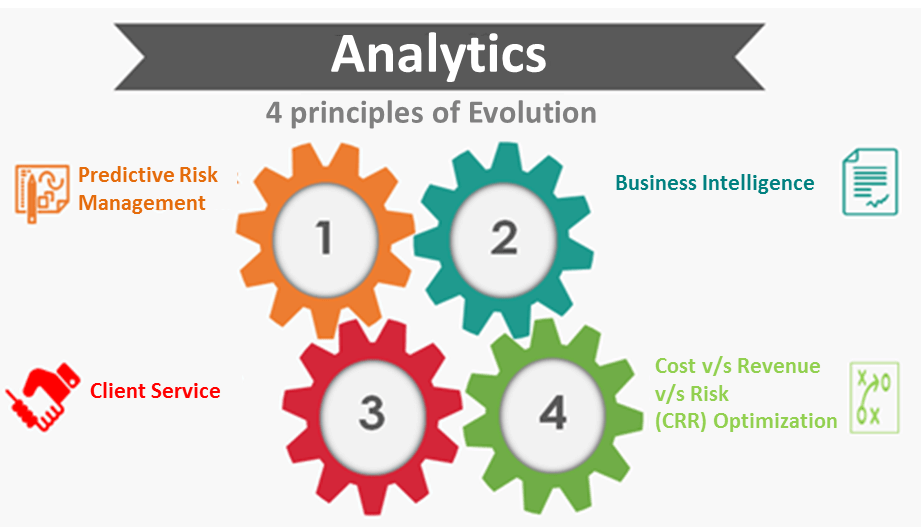

With the advent of Big Data & Analytics, the role and value proposition of analytics has transformed exponentially. While there could be multiple areas where analytics can assist Shared Services, the four key dimensions to focus upon immediately are Predictive Risk Management, Business Intelligence, Client Service (Quality) & Cost vs. Revenue vs. Risk (CRR) Optimization.

-

Predictive Risk Management

At a time where dwindling revenues lay significant impetus on cost, losses arising of operational risk events are often unanticipated and inappropriately accounted for. This reinvigorates the belief that cost aside; risk could be the uncalled for event which could jeopardize not only the credibility of shared services but also impact the organization’s aspiration.

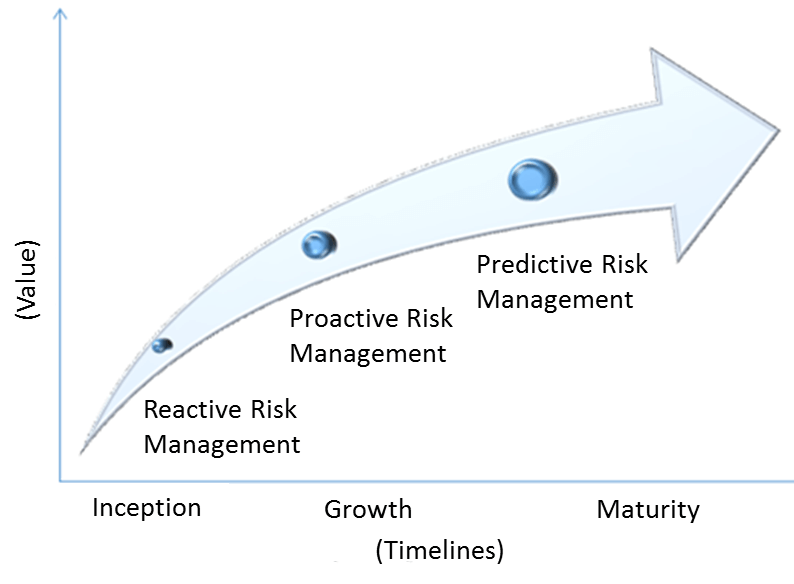

At the nascent stage of Shared Services build out, reactive risk management seemed to qualify as an acceptable approach given the lack of experience and exposure. A few firms have moved forward by exploring ways and means of identifying and managing risk proactively but that said, geo-political uncertainty along with high economic volatility makes predictive risk management the need of the hour. Put simply, these risk management approaches can be explained as follows:

- Reactive Risk Management – refers to identification of a risk post trigger but after impact

- Proactive Risk Management – refers to identification of a risk post trigger but before impact

- Predictive Risk Management – refers to identification of the potentiality of risk much before an event initiating risk is triggered.

As seen in the diagram on the above, unlike reactive and proactive approaches, predictive risk management assists in identifying potentiality & feasibility of occurrence long before a risk is triggered. This requires Shared Services to go beyond the day to day risk management approach and instead review and challenge the principle behind “why we do what we do”.

A Case Study from Investment Banking Industry showcasing the Shared Services Trajectory:

Some of the levers which can aid Shared Services in progressing towards Predictive Risk Management are:

-

-

Failure Mode & Effect Analysis (FMEA) – More often than not, we are focusing on solving a known problem or issue and hence are unable to comprehend potential issues looming around. While these have not yet translated into an impact, one cannot negate the possibility. FMEA, as a tool, will assist in evaluating all possible failure scenarios and help Shared Services broaden their outlook around potential risks.

-

“x”MI – Expanding MIs across Shared Services to act as a lead measure providing insights into various dimensions such as potential risks, client satisfaction, patterns, trends etc. “x” could therefore represent any of the said dimensions and provides flexibility to Shared Services to think aloud instead of restricting MIs to their existing forms and application

-

Zero Tolerance – It is important to identify themes or areas that are integral to Shared Services and hence any breaches across these themes or areas could jeopardize the credibility of Shared Services. Increased focus in identifying and remediating gaps, if any, across these will help Shared Services create a robust control architecture which is forward looking and fit for purpose.

-

Culture – Driving a culture which encourages and rewards predictive risk management is a cornerstone for Shared Services. Maintaining transparency across levels and encouraging people to speak up will promote inclusivity and also ensure a “No Surprise Culture”. It is important that the context is set from the top and driven across the organization so that everyone is coherently working towards achieving the organizational objective of predictive risk management.

-

- Business Intelligence

Leveraging analytics to unlock insights is a great asset to deliver “Value” across Shared Services. Given the scale and visibility across geographies provides a unique view of client, processes and other intricacies. To realize this, Shared Services should leverage existing information with an objective of:

-

Re-engineering – More often than not, processes have transitioned on an “as-is” basis for sake of materializing cost saves at an earliest. These processes have remained the same over years. Whilst these were fit for purpose then, evolution of external and internal environment over years need Shared Services to review these process from an “outside-in” perspective challenging the status quo and as a part of this journey re-engineering the same to load balance and do “more for less”.

-

Standardization – Not only does this provide an efficiency advantage it goes a long way in eliminating non-value added (NVA) activities, adding meaning to what people do within Shared Services. This also sends a positive message across the entire organization about the management’s commitment towards ensuring that people are constructively engaged and not confined to following procedure manuals turning their day job into a procedure driven, repetitive and linear tasks with no room for self-development.

-

Gaining Insights – Reviewing data to comprehend trends and patterns offer a great opportunity to develop intelligence and insights that could reduce costs and enhance revenues. This component is a “game changer” which could help Shared Services evolves into a trusted partner for the overall organization. The value generated through these insights go way beyond cost arbitrage and will ascertain the position of Shared Services and help explore the huge talent pool available in the country.

-

- Client Service (Quality)

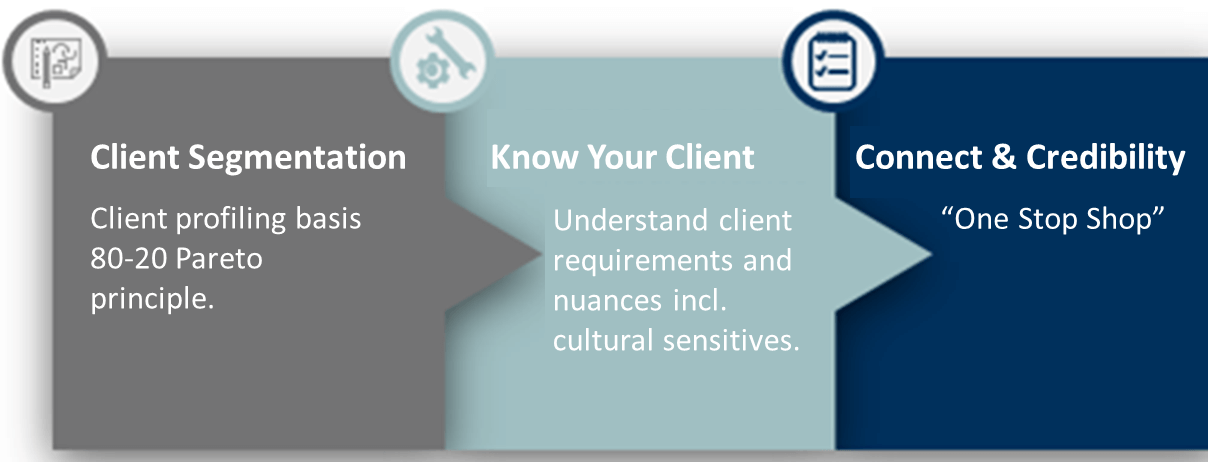

Client centricity and delivering highest quality go a long way in differentiating one firm from the other in a highly competitive environment. Shared Services can therefore create an impact by delivering superior client experience. To achieve this, it is important for Shared Services to embed the following into their overall client service strategy:

-

Client Segmentation – It is important to profile client’s basis the 80-20 Pareto principle to identify ones which truly make a difference to the firm’s bottom line. It is imperative that Shared Services focuses to ensure there are no service delivery failures or gaps which could potentially nudge the client to move to competitors. Number of surveys across the globe have pointed that it is the quality of service which helps foster trust and partnership with clients.

-

Know Your Client – Subsequent to segmentation, Shared Services must endeavour to understand the nuances including cultural sensitivities to better comprehend client requirements, preferences and expectations. There needs to be continuous monitoring and governance of all aspects intersecting with priority clients. This will help Shared Services stay ahead and proactively manage client’s expectation creating “Aha” moments for their clients.

-

Connect & Credibility – We all like to get answers from a single point of contact who understands what we want. Similar to this, client’s find it difficult to navigate across various teams to get an answer to their question. Having a dedicated “Key Client Champion (KCC)” helps establish client connect and create credibility for Shared Services. Leading surveys across industries have opined that it is the quality of service that differentiates the best from the rest.

-

- Cost versus Revenue versus Risk (CRR) Optimization

Lastly it is important for one to understand the “Cost” of doing business. Historically, Shared Services have introduced be-spoke processes and arrangements without taking into account cost versus revenue view

In hindsight, when we look into this dimension, we may realize that the return on investment (ROI) for the firm for catering to such arrangements is negative.

Moreover, it introduces a variety of risks considering these arrangements deviate from the norm. This essentially is a perfect candidate for leveraging business intelligence to gain insights into cost per transaction (basis efforts). Comparing this with the revenue and incremental risk will provide a holistic perspective and also helps Shared Services do “more with less”.

The below equation summarizes this concept and should help drive meaningful decisions.

V = R – C r

Where V reflects Value

R stands for Revenue

C represents Cost

r represents risk

Conclusion

As the conventional lever of cost arbitrage fades away rapidly, Shared Services that don't adapt and re-model themselves will perish very fast. The biggest advantage for a country like India is the richly diverse, overqualified and underutilized talent pool. This is a huge opportunity for Shared Services as it can re-model, and greatly amplify its value proposition by leveraging Technology and Analytics. The impact of this will be far beyond the stereo type of cost, thereby opening up infinite value accretion possibilities.

ABOUT THE AUTHOR

N Rangarajan, is the Managing Director, Head of Operations, in global Shared Services centre of a Global Investment Bank in Mumbai; and an Alumni of GE Capital where he worked in Finance COE for over 8 years till it transformed into Genpact. Work Experience includes Audit, Core Finance, Commercial, Six Sigma Master Blackbelt, Offshoring, Change Management and IB Operations.

He is a CA and CWA.