Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowThe growth of “digital labour” will affect organizations for many years to come. In the short term some organizations may struggle with disparate and uncoordinated automation initiatives, as well as fragmented underlying IT systems and applications. There will be continuing uncertainty over where to start, when to, and how to invest in automation. In particular, talent management challenges will need careful consideration.

The current evolution of automation technology is transforming the face of the finance organization for the better, presenting today’s business leaders with a unique opportunity. Leaders that choose to embrace the change will thrive. Those that don’t, risk irrelevance. It’s stark and very simple.

Within the automation choices available to CFOs that have recently emerged, RPA has garnered significant market attention - and for good reasons. Research suggests that the benefits of adopting RPA in finance go way beyond cost reduction bringing improved control, faster processing speed, better data quality, and happier finance team members freed up from mundane tasks for interesting and value-add work.

The current evolution of automation technology is transforming the

face of the finance organization for the better, presenting today’s

business leaders with a unique opportunity.

An examination of the leading practices that organizations are deploying to implement RPA and the current rate of adoption suggest that finance has some way to go. Most Finance leaders believe that their teams have either not trailed or fully applied robotics. This is a missed opportunity, particularly for smaller organizations that are less likely to have started the RPA journey. That is not to say that RPA adoption is without its challenges. There is opportunity to extend the understanding of the technology and its successful application across finance, and the case studies in this report demonstrate that deploying RPA is as much about change management and stakeholder engagement as it is about implementing the software. Depending on the ambition, combining RPA with traditional automation tools, such as workflow, lean methodologies, and new intelligent automation solutions can be the cornerstone of an extreme automation strategy for finance that is truly transformative. CFOs have the opportunity to reshape their organizations and take a proactive approach to shaping their teams to combine human and digital labour. This will require visionary leadership from CFOs, a change in culture, and the digital mindset of finance and the whole organization.

Opportunity for Robotics

In the face of growing disruption, business leaders are increasingly aware of the threats and opportunities presented by technological innovation. Organizations seeking a competitive advantage have adjusted their strategic priorities to deliver digitization across the business to enable greater speed to market and data driven insights. Technology alone is not the panacea to finance transformation, and tomorrow’s transformed digital finance organization goes way beyond implementing a few shiny new tools. In this brave new world the one thing above anything else that is needed by the business is speed of execution. For CFOs that is a call to arms for finance automation. So to understand what automation really means to finance, we start by exploring robots in the finance team, and go on to take a brief look at Intelligent Automation.

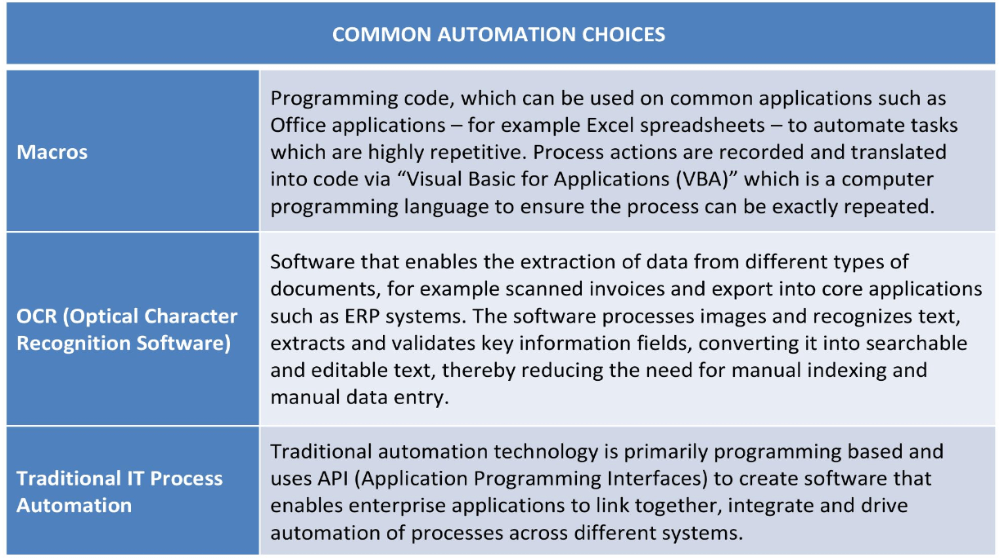

As a matter of fact, automation is not a new agenda item. CFOs are well accustomed to selecting from different automation choices. Using process improvement methodologies including Lean and Six Sigma, the finance team has a long history of successfully implementing tactical solutions – from simple macros and workflow tools, through to more complex IT infrastructure led deployments and ERP enabled transformations.

Interestingly, these historical approaches and tactical solutions are now being used in conjunction with emerging technologies to yield significant benefits. While previous improvement projects have driven standardization and elimination of non-value adding activities, the question that should now be asked is “How do we automate it?”

RPA vs. Traditional Automation Technologies

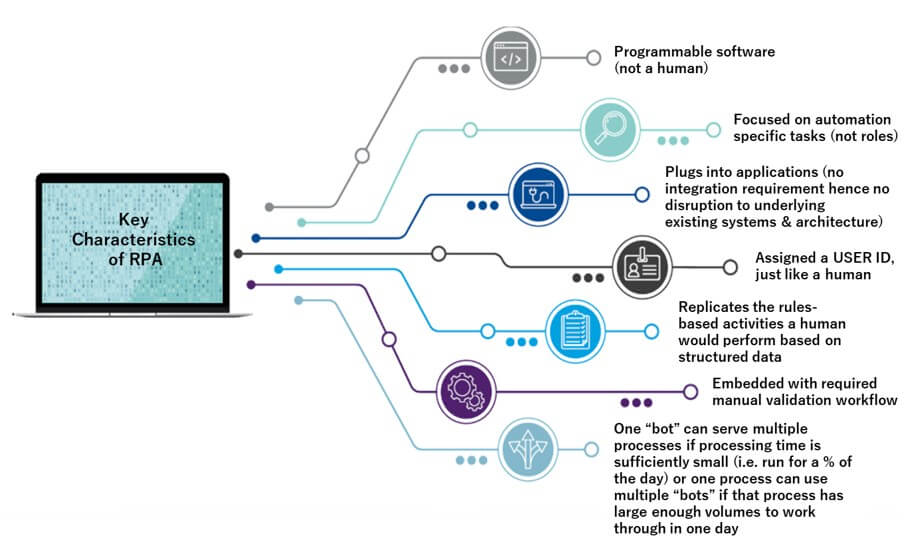

RPA is system agnostic. It sits “on top of” existing applications and replicates the actions of a human user at the user interface level. This means there is no need to change, replace or compromise existing enterprise applications for the software to work.

Traditional automation solutions, in contrast, operate by integration into the system environment through APIs (application program interfaces) which enable the transfer of data and information between one application and another.

As the corporate IT landscape has become more complex it is becoming more difficult to integrate and automate processes across multiple systems.

In choosing between API integration and RPA integration the issues to consider include:

- The availability of the API/ source code to facilitate integration in the first place

- The licensing and operating cost of connecting through APIs versus similar RPA costs (cost benefit analysis)

- How quickly the automation fix needs to happen

- The complexity and business criticality of process automation

- The likelihood of significant on-going system application changes or a future system upgrade. In such cases, APIs will generally be a better option as RPA can be more vulnerable to changes in the underlying systems in terms of reprogramming.

RPA may not be the one stop solution for all automation opportunities, but the speed, ease and relatively low cost with which it can be implemented to connect data across different systems can differentiate it from other traditional automation approaches.

HOW DOES FINANCE IDENTIFY AUTOMATION CANDIDATES?

Based on analysis of leading organizations, there are 2 important steps when commencing the journey:

- 1) Defining an automation selection charter

- 2) Running a proof of concept

CASE STUDY: Shell

ELIMINATE, SIMPLIFY, STANDARDISE....THEN AUTOMATE (ESSA)

Shell’s Finance & Data Operations is supporting a transformation program intended to ensure Finance is able to deliver more business impact, enable better commercial decisions, but at a substantially lower cost.

Shell’s finance organization has largely centralized operational processes over past years into Finance & Data Operations (FO), which is located in four cost advantaged locations. FO is driving a “smart automation” strategy using low cost tools such as Robotic Process Automation (RPA) to make operational processes more efficient and effective. The goal is to free employees from repetitive, manual work and to focus their time on more value-adding activities. FO sees RPA primarily as a tool to reduce costs, but also recognizes the additional benefits of improved process and data quality as well as having the flexibility to scale up during periods of peak demand.

For FO, RPA software is seen as “one tool in the automation kitbag”, and they see it as part of a broader continuous improvement strategy.

This strategy is based on the ESSA approach - first try to Eliminate waste in the process, if you can't eliminate a step, Simplify it. Once it is simplified, look to Standardize the processes across locations as much as possible. Then look for the Automation opportunity around specific tasks or workflow, which may be RPA or other automation options.

Without simplification and standardization of finance processes, it is difficult to drive replication opportunities as it takes more time, is more difficult to code and build the robots, and are not scalable. RPA is not the solution to a badly designed process.

The combination of heavily streamlined processes with RPA technologies working together with other automation workflow tools and more advanced machine learning capabilities make a significant difference on return on capital. Here the role of the technology solutions architect is critical in supporting the goals of the finance team, helping identify the most relevant automation technology or technologies to apply to the problem once the process maps have been identified, as well as supporting the programming, testing of software and ensuring appropriate integration of the software across the different applications.

The selection of the right automation tools is critical, but it also requires individuals with the right skills to program these emerging workflow automation tools.

An example of a typical project: after implementing ESS stages to the end to end process for updating Customer Master data fields, an RPA "bot" was built to load the data requests in SAP. This was previously a manual and time-consuming activity with lots handoffs and manual data validation steps. The new robot is used to update various kinds of SAP Master Data information in an automated manner and provides a 24x6 execution capability thereby increasing the bandwidth and responsiveness to the business. The average time taken to complete a request has reduced by 40% with 100% data quality being sustained month on month.

The Current State of Play

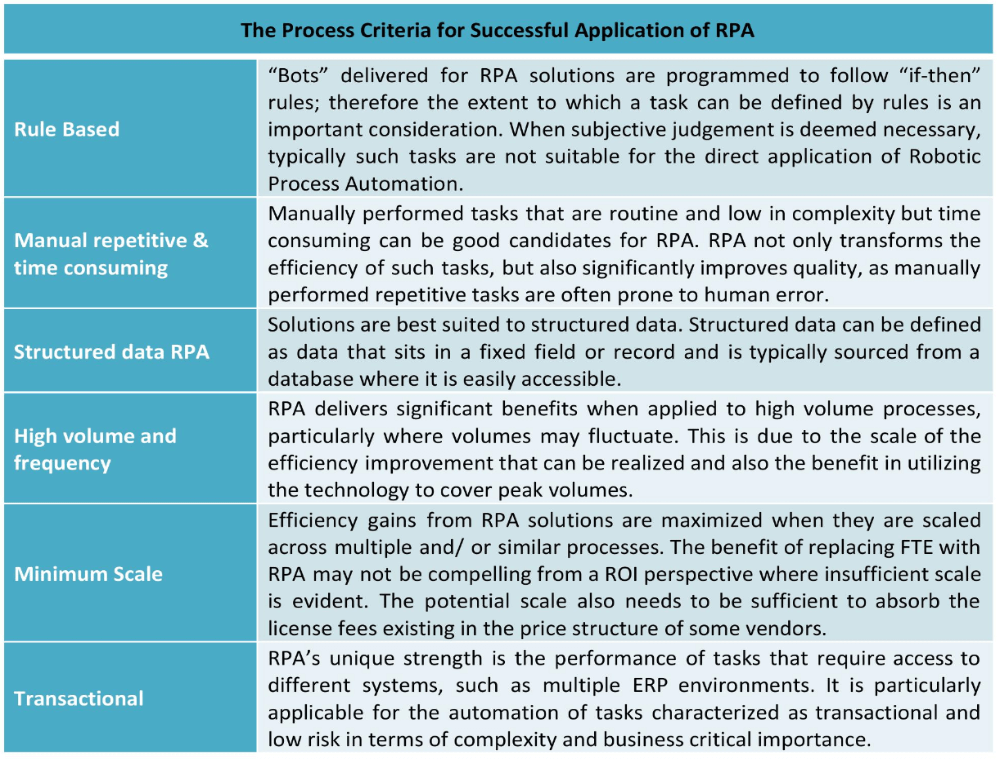

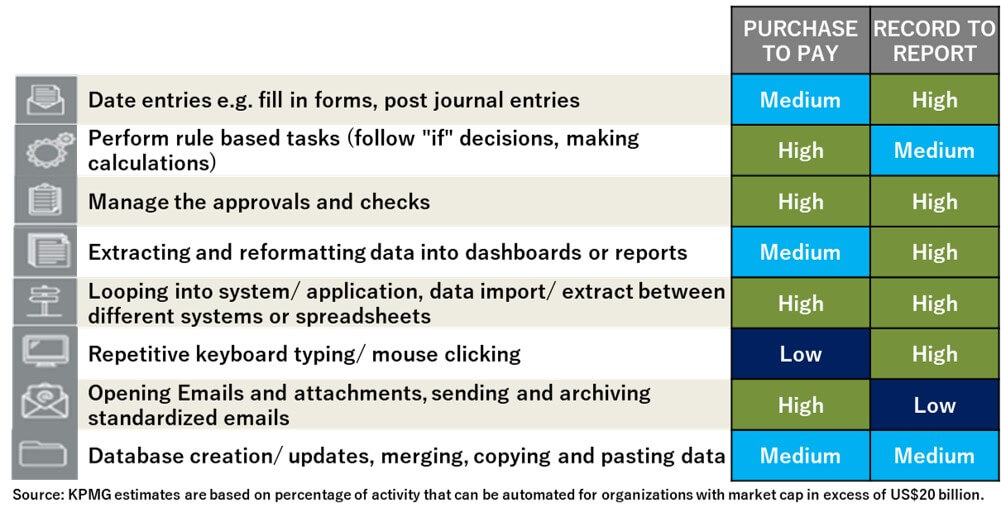

Many Finance teams are either trialing RPA as a pilot or proof of concept or have partially or fully implemented it for all relevant finance processes. There are some clear process front runners for RPA adoption particularly in transactional finance activities with RPA getting traction around the Purchase-to-Pay and Record-to-Report processes, as well as internal performance reporting. RPA benefits in these processes are typically gained from automating data import and export from numerous sources, rules-based calculations and analysis to support checks and approvals and document management as is shown in the table below.

Barriers to Entry

With so many opportunities to apply RPA, the hesitation in embracing this technology lies in the basic knowledge of how it works as well as other competing priorities. This is an issue across organizations of all size, with even the largest companies. This is particularly relevant because RPA is a business “end user” play, first and foremost led by the business. It is critical that finance teams have a strong understanding of the technology and its functionality so they can play a leading role in its implementation both within and outside of finance, understand where it fits in the end-to-end technology roadmap, and help secure the business case for scale up.

The Business Case for RPA

The benefits of RPA adoption are multifaceted, and typically underestimate the non-labour benefits that can accrue. Some of the major benefits are:

-

Improved control.

The tasks performed by a “bot” can be checked and recorded at every step. This produces valuable, analytical information on software performance as well as process visibility, and critically supplies an audit trail which can be helpful for compliance. RPA uses existing information security profiles and configurations, so it does not compromise the internal control of the application it is working with. -

Improved process speed.

As the business demands quicker response times, a key imperative for the finance organization is speed of delivery. RPA transforms the efficiency of routine finance tasks as it can perform a task often within seconds rather than the hours it may take with manual, human intervention. As cycle times are dramatically reduced by the implementation of RPA, process throughput can be increased significantly. -

Reduced processing cost.

The link between RPA and potentially transformational efficiencies is inextricable. Once scaled, the implementation of RPA can result in significant cost reductions for the targeted finance tasks, however it may be misleading to measure this purely in terms of “headcount reduction” per "bot". Reduction in effort is highly dependent on the process step being automated, and this, based on experience and available benchmarks, can vary between 15% and 55%. A more practical measure considers a target cost reduction hurdle rate in comparison to the cost per "bot". -

24-7 Operational capability.

Unlike their human counterparts, “bots” can be programmed to operate 24 hours a day, 7 days a week the whole year round. For the right processes this can triple the available time for processing compared to a human shift. -

Data accuracy.

Access to high quality data is the foundation on which finance teams can look to transform the value they deliver. RPA technology adoption can improve the accuracy and quality of data; “bots” are programmed to follow rules, have data validation capabilities, and do not make mistakes like human beings. This reduces data inaccuracy and quality risk. However, as the software is programmable a mistake in programming instructions can be significant so testing before going operational is vital. -

Improved finance process flexibility to scale.

As RPA is programmable software executing instructions, “bots” can be scheduled to operate at particular times, or to accommodate variations in workload volumes. As volumes increase or decrease the number of robots required can be scaled up or down accordingly or be reallocated to more urgent activities. -

Improved process performance visibility.

A valuable feature of many RPA software products is the availability of analytics information on “bot” performance, which can provide valuable insight into process performance for optimization. -

Ease of deployment of customized process solutions.

The very nature of the technology, being end-user led, means that the RPA software can be programmed across highly customized and bespoke processes assuming there is cost benefit in applying the software.

Roadmap for Implementation

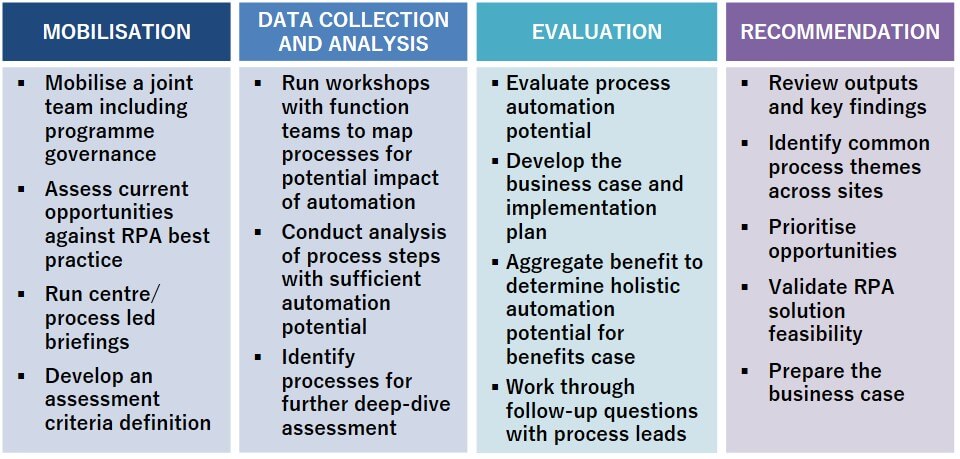

Organizations who have implemented RPA successfully follow a number of key steps during implementation, supported by a process to assess RPA feasibility, as below:

-

Prioritize the finance areas for automation

Opportunity assessment is an important start for finance to identify the areas for improvement as well as a fit-for-purpose solution, noting that process improvement can be achieved by many enablers including but not limited to RPA. -

Develop a multifaceted roadmap for implementation

Finance leadership, stakeholders and team members should define the automation strategy and roadmap together. The roadmap must address the phasing of deployment, investment, benefits and savings drivers of each initiative, the organizational change impacts of transition, including training and hyper care, and the cultural change to drive adoption, encourage innovation and minimize uncertainty. -

Select the right providers and partners to support design and implementation

RPA specialists or third-party developers must be involved in the early stages of design to bring RPA insight, particularly for the proof of concept. This will also help build in-house capability, avoid hardware and software pitfalls and provide software selection as well as implementation know-how. -

Build an enterprise-wide delivery model and governance strategy to help oversee the program

With an RPA governing body, organizations will benefit from the centralized control to minimize the risk associated with the technology enablement and realize the value of RPA. -

Establish a change management strategy to drive adoption throughout finance

Strategies can include initiatives such as developing RPA capabilities in business process leads rather than focusing on technical staff, using experienced and inexperienced teams for "bot" development to promote skills and knowledge transfer and partnering with organizations that have a deep RPA capability to support the programs as required.

Next Steps on the Automation Horizon

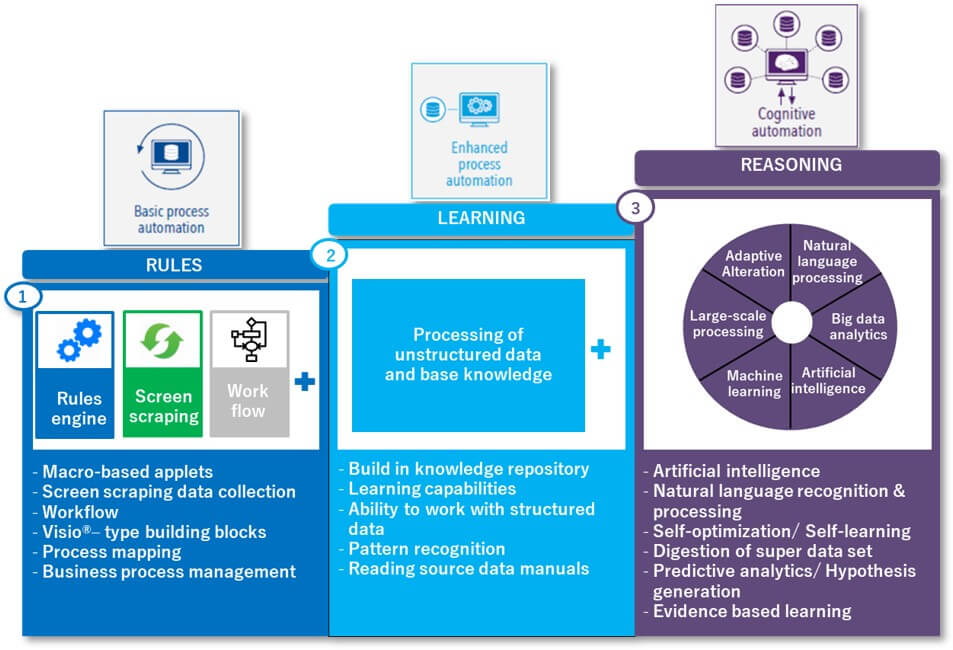

The following figure outlines the combination of technologies that will be increasingly used in the future to automate business processes, operations and analysis – from robotics on rules-based processes, including basic OCR and screen scraping, through to the application of sophisticated “intelligent automation” involving “cognitive machine processing” and elements of artificial intelligence. These technologies sit on top of existing IT architecture components and in their most advanced form can interpret data from multiple sources to make decisions. The reality for most finance functions is that innovation leveraging automation remains focused around basic process automation, where processes are primarily rule-based using structured data. The primary technologies used have been simplistic automation tools such as macros, workflows and web-based screen scraping technologies, as well as traditional API based automation interventions.

These have been complemented by broader business process management tools, particularly the adoption of Lean and Six Sigma methodologies. For organizations that have embraced the automation journey, the need for solutions beyond the capability of standard RPA technology such as Intelligent Automation is emerging.

Whilst it is clear RPA tools can confer significant benefits to organizations, ultimately the robots are simply programmed to follow rules, and cannot be considered to be “smart”. Standard RPA technology cannot adapt to changing conditions or self-learn from previous experience.

This capability has the potential to unlock another wave of opportunities for further efficiencies within finance operations. The increasing ability to automatically analyze very large data sets will help CFOs decide whether to invest capital to expand capacity. Machine learning will enable them to consider many more factors than just internal company metrics and econometrics when considering risks that may affect the business. The progressive deployment of these technologies across the enterprise will further enable the ‘digitalization’ of labour, exploding the automation potential for enterprises.

About ACCA

ACCA (the Association of Chartered Certified Accountants) is the global body for professional accountants, offering business-relevant, first-choice qualifications to people of application, ability and ambition around the world who seek a rewarding career in accountancy, finance and management.

ACCA supports its 208,000 members and 503,000 students in 179 countries, helping them to develop successful careers in accounting and business, with the skills required by employers. ACCA works through a network of 104 offices and centres and more than 7,300 Approved Employers worldwide, who provide high standards of employee learning and development. Through its public interest remit, ACCA promotes appropriate regulation of accounting and conducts relevant research to ensure accountancy continues to grow in reputation and influence.