Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowEthical behavior is normally associated with ‘doing the right thing’. For professional accountants this involves much more than just an intuitive sense of following one’s conscience. While that is certainly important, being ethical also brings with it specific expectations, such as demonstrating professional competency in the role being performed, exercising due care towards stakeholders and acting to uphold the public interest.

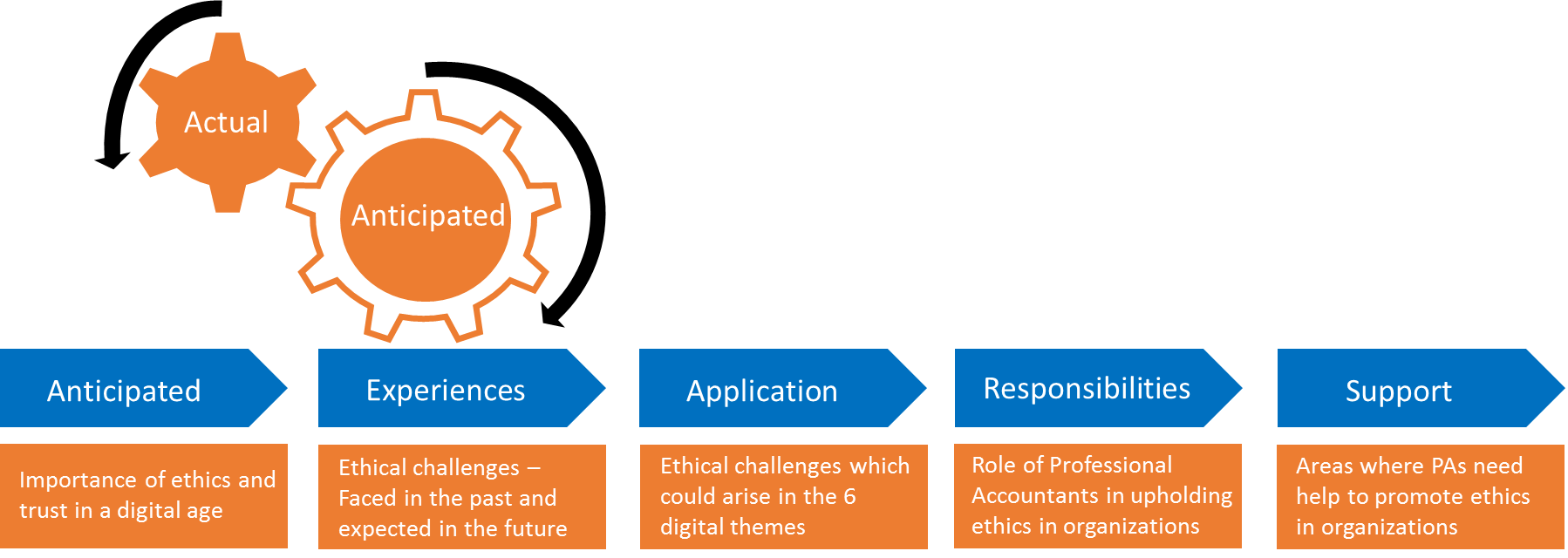

In order to lend specificity to any analysis of ethics in a digital environment, ethical aspects should be identified across six digital themes:

- Cybersecurity;

- Platform-based business models;

- Big data and analytics;

- Cryptocurrencies and distributed ledgers;

- Automation, artificial intelligence and machine learning; and

- Procurement of technology.

In a fast-evolving digital age, clients and other stakeholders are much more likely to continue investing their trust in the accountant if they believe that this individual will always act in an ethical manner.

The fundamental principle which emerges most frequently as being at risk of compromise is professional competence and due care. This may be a reflection of the extent to which work situations in a digital age can present new information with ethical aspects that have not been seen before. Strong ethical principles and behaviour will become even more important in the evolving digital age. And the accountant’s ethical behavior helps the organization build trust with internal and external stakeholders. In other words, technology may have an impact on the details one needs to understand in order to be ethical, but it does not change the importance of being ethical. The fundamental principles for accountants, established by the International Ethics Standards Board for Accountants (IESBA), still apply and remain relevant in the digital age.

Key considerations pertinent to ethics and trust in a digital age are as given below:

Values and Importance of Ethics

Strong ethical principles and behaviour will become more important in the evolving digital age. This seems largely driven by the potential for a range of threats and associated breaches.

The pace of change and the need to absorb new information specific to digital scenarios, is driving the fact that this area will become even more important in the future. In addition, ethical behavior does help to build trust in the digital age.

This is important as the ability of professional accountants to create value depends crucially on their ability to win the trust of their stakeholders. In a fast-evolving digital age, clients and other stakeholders are much more likely to continue investing their trust in the accountant if they believe that this individual

…upholding their own professional code (‘ethics begins with me’) and embedding ethical standards in day-to-day procedures are good ways of contributing to the organization’s ability to uphold ethics.

Most professional accountants too feel that upholding their own professional code (‘ethics begins with me’) and embedding ethical standards in day-to-day procedures are good ways of contributing to the organization’s ability to uphold ethics. This suggests a need to combine a procedural or tactical understanding with a wider view – something that might become particularly important when looking ahead to new or previously unseen situations in a digital context. If procedures have not been tested and well understood over several years, say if dealing with a new area such as internet platform based operations, then understanding the overarching strategy and purpose becomes particularly important. Otherwise, there may be a risk of compromising ethics through unintended consequences or performing the wrong procedure.

Experiences and Ethical Challenges

Looking across personally experienced instances as well as those that had been observed, it is apparent that challenges do appear from time to time. Of particular concern, is when an incident of experiencing pressure to compromise is not reported. Another very commonly compromised principle is that of integrity – in other words, being straightforward and honest in all professional and business relationships. This may be reflective of various underlying reasons, such as a wider culture of acceptance of the unethical behavior concerned, or the lack of a well-communicated organizational ethics policy.

A well-publicized ‘speak-up’ policy, with appropriate anonymity or protection features is not very common. And a few leaders do not even believe that reporting incidents is a way of contributing to their organization’s efforts to uphold ethics. All these findings suggest the need to explore whether there is sufficient support and encouragement to ensure that professional accountants feel able to report unethical behaviour. Reporting of unethical behaviour may need further strengthening to be more effective in helping professional accountants to act as the ‘ethical conscience’ of their organizations. In addressing this, though, it will be important to understand the particular situation of the organization. For instance, ‘speak-up’ behaviours may flow more naturally when the culture is more aware and supportive of ethical conduct; in other words forced imposition of a policy may not always be the most effective method of creating an ethical culture.

Application of an ‘Ethical Lens’

As mentioned above, the principle that is under threat of compromise is professional competence and due care. A response option to that situation requires building up a high standard of knowledge and understanding of the situation and its context before being able to act in an ethical manner. A lack of knowledge and expertise will create the risk of compromising professional competence and due care obligations.

When accountants reflect on principles that are mostly compromised, integrity features very highly. It seems that risks of compromise go way beyond issues of honest and straightforward professional/ business relationships. For example, it is difficult to apply ethical judgment on the use of distributed ledgers without an understanding of what they are, or the opportunities and challenges they pose.

“ This report’s approach to ethics is anchored in three facets that reflect ACCA’s priorities in this area... Firstly, it is future-looking, with an emphasis on new or emerging ethical considerations in an evolving digital age. Secondly, it takes an applied approach that assesses ethical implications with respect to specific digital themes and real-world situations. Thirdly, it reflects a global point of view, with perspectives informed by over 10,000 survey respondents across 158 countries,and roundtable discussions with senior practitioners in nine countries ” says Helen Brand OBE, Chief Executive, ACCA .

The professional accountant of the future will need, in addition to technical capability, a rounded skill set that demonstrates key quotients for success in areas such as experience, intelligence, creativity, digital skills, emotional intelligence and vision. And at the heart of these lies the ethical quotient.

Responsibilities

Professional accountants always need to act in the public interest. This is a fundamental responsibility that goes to the heart of being a professional accountant. And upholding their own professional code should be viewed as the most preferred way of contributing to their organization’s ability to uphold ethics – as should embedding ethics into the strategy and business plans. Therefore there may be a need to combine a procedural or tactical understanding with a wider view – something that might become particularly important when looking ahead to new or previously unseen situations in a digital context. If procedures have not been tested and well understood over several years, say if dealing with a new area such as the adoption of internet-platform-based operations, then it becomes particularly important to understand the organization’s underlying strategy and purpose to avoid compromising ethics through unintended consequences or wrong procedures.

Support for Promoting Ethics

First and foremost, a strong ethical leadership is required to set the tone at the top where support is needed for promoting ethical behavior in organizations. The leadership tasks in principle are to:

- provide guidance on creating, implementing and managing a code of ethics

- raise awareness of the repercussions for breaching the organization’s/ client’s code of ethics,

- provide best-practice training materials,

- establish evaluation processes that include assessment of ethical behavior,

- create a well-publicized speak-up policy, with appropriate anonymity / protection for users,

- establish an Ethics Committee to consider ethical dilemmas and lead the organization in embedding an ethical culture.

Conclusion

Looking ahead, it seems likely that risks of ethical compromises go way beyond issues of honest and straight forward professional and business relationships (integrity). The professional accountant of the future will need, in addition to technical capability, a rounded skill set that demonstrates key quotients for success in areas such as experience, intelligence, creativity, digital skills, emotional intelligence and vision. And at the heart of these lies the ethical quotient.

To behave ethically and instil trust in a digital age, professional accountants will need to learn new information relatively quickly, and to apply their judgment to this information, often in situations they may not have seen before. It will also be important to have an open mind that recognizes the value of what has been learnt so far, but with an understanding that this has to be continually placed into the context of situations as they evolve. At the very least it would seem beneficial for professional accountants to bear in mind the following as they navigate ethical situations in the digital age:

- Build knowledge of emerging technologies and digital issues: to reduce risk of compromise to professional competence and due care.

- Combine process control with a strategic view: to reduce the risk of unintended consequences.

- Evaluate mechanisms for reporting unethical behaviour: to reduce the risk of breaches.

About ACCA

ACCA (the Association of Chartered Certified Accountants) is the global body for professional accountants, offering business-relevant, first-choice qualifications to people of application, ability and ambition around the world who seek a rewarding career in accountancy, finance and management.

ACCA supports its 208,000 members and 503,000 students in 179 countries, helping them to develop successful careers in accounting and business, with the skills required by employers. ACCA works through a network of 104 offices and centres and more than 7,300 Approved Employers worldwide, who provide high standards of employee learning and development. Through its public interest remit, ACCA promotes appropriate regulation of accounting and conducts relevant research to ensure accountancy continues to grow in reputation and influence.