Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowIf you could start with a blank piece of paper, how would you design the finance team, and would it resemble in any way the structures we see today?

Finance functions across many organizations are at a key point in their development. They need to evolve to create the value sought by their customers, both internal and external. The finance team of tomorrow needs to be dynamic and forward looking, as much as it is retrospective. A clear undercurrent of this discussion is the need to rethink the culture and purpose of finance.

What is the nature of this challenge and how prepared are they for it? What is the relevance to attaining this future state of the discussion in which the finance community is engaged? This report is a story of relevance and organizational success in the face of challenge.

Six Hypotheses Driving the Future of Finance

The report, based on a series of interactive workshops with finance professionals, interviews and survey responses, considers several common views on the key attributes of finance function of tomorrow and explains how these might be addressed by forward-thinking finance teams. Many of the suggestions come from those who have embraced the change.

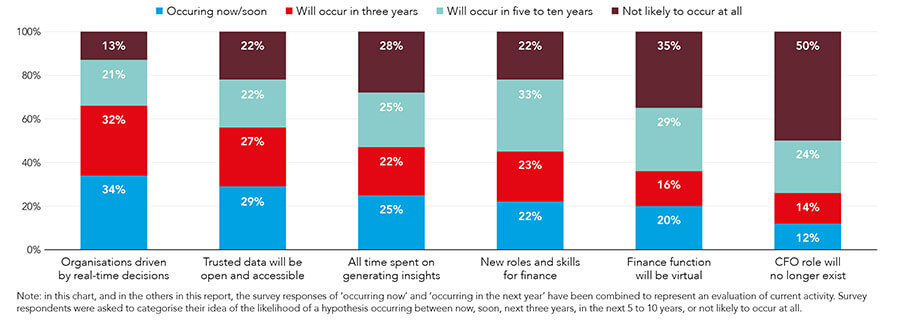

The research is based around six hypotheses that were defined on the basis of conversations with finance practitioners. These represented differing views on the future finance function. These six hypothetical evolutions of finance are:

- Accessible, trusted data will drive real-time, customer-centric decision making

- Trusted data will be open and accessible across the organization

- Finance teams will spend all of their time on generating insights

- Traditional finance roles will disappear. New roles, skills and career paths will be needed

- The finance ‘function’ will be virtual

- The traditional CFO role will no longer exist

The chart below represents the overall assessment of the six hypotheses: the initial comparison – ordered by the percentage of respondents who consider it to be occurring now/soon.

Dimensions Underlying Evolution of Finance

The opportunity for the finance function of the future is borne upon the need to consider how it manages a number of dimensions, as in the figure below.

We have traditionally spoken of the importance of people (skills), process and technology in transforming organizations and in establishing internal control. The importance of data to the success of the organization warrants the inclusion of this as a fourth dimension. Supporting all these is the transition in the culture of the organization, and of the finance function, to being more flexible and adaptable.

The ability to serve the organization’s purpose in the functions that it performs is fundamental to the future success of finance. To achieve this, the finance function needs to consider each of these dimensions in isolation, but more importantly together, while considering the six hypotheses.

- Organizations will be driven by real-time, customer-centric, decisions: 87% of the survey respondents overall foresaw this hypothesis being realized in their organization, with two-thirds considering it would be achieved in either the short and/or medium term. The need to focus on better decision making using data is key. Using technology such as machine learning to improve forecasting abilities will enable finance professionals to remain at the centre of decision making. One challenge is that our internal processes and controls now need to be adapted to the functionality of the cloud application rather than being tailored to the organization.

-

Trusted data will be open and accessible:78% of our survey respondents see data as being at the core of the organization of the future. Increasingly there is no distinction between operational data and finance data; from a technical perspective, finance data is simply operational data that has a financial value attached to it. Finance itself needs to review its approach to data:

- Understand the key data that drives organization and ensure appropriate governance over it.

- Initiate a culture change in data ownership across the organization.

- Ensure that the finance function has access to sufficient and appropriate data management skills.

- Finance teams will spend all their time on forward insight not rearward review:The communicator and business partner groups are closely aligned to the insights and strategic goals expressed in hypotheses related to real-time decision making and the focus on forward planning. These roles shift focus from communicating the results of transactions and reconciliations to insightful analysis and a seat at the decision-making table to drive strategy. This process of moving finance up the value chain requires an efficient organization structure that releases capacity for teams to focus on business-facing activities. The final step is for finance to become a true business partner – achieved by aligning behaviors, building the right skills, and being able to speak the business’s language.

-

New roles, skills and career paths will be needed: If we are bringing financial skills closer to business by increasingly supporting forward looking decision making, then this will clearly change the skills that the accountant needs, as well as their future roles in the organization. Given the scenario, following need to be reviewed:

- skills mix needed for the successful finance function, accepting that no one individual needs all the skills – it is the team that matters here.

- career paths to ensure that development paths reflect opportunities that the organization can offer.

- a culture of learning to ensure that finance team members have the relevant skills to address business needs.

-

The finance organization of the future will be virtual: For many organizations, the use of financial acumen across the range of activities is key to strategic success, and there is a need for centers of excellence, or, rather, centers of expertise, to be maintained and reinforced for areas such as treasury and reporting. The next step forward would be to:

- Evaluate finance organizational structure and create a flexible model that recognizes expertise in different areas.

- Embed a more agile working culture that can deploy finance skills across a range of projects.

- Review location strategy and ensure that finance competence is located as an integral part of the decision-making process.

-

The traditional CFO role will no longer exist:The survey data indicates that respondents expect the role of the CFO to broaden in the coming years. Considering the 3 dimensions: level of responsibility, which showed a significant shift; focus on business performance and strategy, which although increasing was not as marked; and finally, client and market development, where the pattern was very similar to the business performance category, following are the actionable points to be considered:

- Appraise the development paths of the high-performing finance professionals to ensure that the leaders of tomorrow have the relevant skills.

-

Create career paths that include both operational and finance experience.

- Invest in agile leadership skills for senior finance team members.

- Reappraise the internal organizational structure to bring finance closer to strategic decision making.

Key Actions for Finance Leaders

- Ensure that finance competence is at the core of strategic decision making.

- Promote a culture of learning to ensure that finance team members have the relevant skills to address the business need.

- Understand the key data that drives the organization and ensure appropriate governance over it.

- Enact a technology strategy for the organization, including finance, that uses ‘best-of-breed’ cloud-based systems.

- Include investment in automation tools in the finance component of the technology strategy.

This is a story of opportunity not threat. In seizing the opportunity finance leaders need to ensure that their teams are aligned closely to the purpose of the organization. They need to create a finance function that serves the organization better in a constantly disrupted world. There is a reality that change will come, so it is important to reflect on how prepared we are for that change.

This is also a story of challenging a traditional culture of finance and recognizing that the agile spirit is one that can lead to success, given that culture change is often one of the hardest things to achieve.

ABOUT ACCA

ACCA (Association of Chartered Certified Accountants) is the global body for professional accountants, offering business-relevant, first-choice qualifications to people of application, ability and ambition around the world who seek a rewarding career in accountancy, finance and management.

ACCA supports its 208,000 members and 503,000 students in 179 countries, helping them to develop successful careers in accounting and business, with the skills required by employers. ACCA works through a network of 104 offices and centers and more than 7,300 Approved Employers worldwide, who provide high standards of employee learning and development. Through its public interest remit, ACCA promotes appropriate regulation of accounting and conducts relevant research to ensure accountancy continues to grow in reputation and influence.

ACCA is currently introducing major innovations to its flagship qualification to ensure its members and future members continue to be the most valued, up to date and sought-after accountancy professionals globally. Founded in 1904, ACCA has consistently held unique core values: opportunity, diversity, innovation, integrity and accountability. For more information visit: www.accaglobal.com

You can access the complete report at –

https://www.accaglobal.com/content/dam/ACCA_Global/professional-insights/Financejourney/pi-culture-future-finance-function%20v7.pdf