Would you like to start a conversation with other industry leaders to brainstorm a challenge or to just know more on a particular topic?

Engage in online discussions with your Peers

Start NowDigital is revolutionizing the workplace and reframing the debate on how successful businesses operate. Technology is creating new opportunities for connecting with customers and opening new channels to markets. The businesses that are prepared and able to adapt fastest to this change will be those that reap the rewards. In the face of seemingly bewildering technological possibilities, how should Finance chiefs even begin to navigate the tech landscape? Where should they place their digital bets? And how can they take advantage of the significant opportunities that digital revolution may present?

Opportunities for Finance Function in the Digital Revolution

Everything that we do leaves a digital footprint: a data record in the vast data pool that humanity is creating. Human societies are living, and benefiting from a life based on electronic footprints: automation, call centres, robots, and tools that can perform tasks with increased efficiency and reduced cost. This creates opportunities but also challenges the basis of our traditional ways of working.

Leaders need to work on how to gain competitive advantage from the insights that the data now available can reveal through effective enterprise performance-management processes. Whatever the size of the business, technology change is having an impact. In this corporate race for future relevance,recognising the digital opportunity is what counts.The revolution has started and adaptation is critical for survival. Forward thinking CFOs grasp this reality, and see the opportunities for influence at the heart of the organisation.They appreciate that they need to:

- understand how to use the information available to them to provide strategic insight in real time;

- think forwards not backwards and maximise the use of technology to do this;

- ensure they have in place effective and efficient processes that satisfy the overall business requirements of Finance; and

- capture, measure, report and predict future performance in a much more agile manner to support better and quicker decision making.

Finance has to help the business make decisions on the basis of the right data... (and)... play a much more operational role in making our businesses operate faster and more decisively.

A failure to follow in this direction could risk marginalising the Finance function at the leadership table. “It’s not enough to become more efficient. Finance has to help the business make decisions on the basis of the right data. We have to play a much more operational role in making our businesses operate faster and more decisively. Many of the tasks that currently take up so much of our time will be covered by Artificial Intelligence and Automation”, explains Holger Lindner, CFO, Global Product Service Division, TUV SUD Singapore.

CFOs and Finance leaders need to understand how technology can enable them to transform the Finance function, and they have to be agile about it. Technology provides data but Finance heads need to exercise judgment and provide insights to turn that data into relevant information. This may require combining several technologies to address the complete business requirements. It is therefore essential to have a robust roadmap that is inclusive of a comprehensive, yet flexible future vision.

In the words of Thomas Zipperle, CFO, SAP South East Asia, “We have to take the risk of changing a process that might be working today but most likely will no longer work in five or 10 years’ time – or,even if it does still work, will have cost us competitiveness and relevance as were unable to adopt to the new reality”.

By understanding what the business needs from the Finance function, it is possible to develop a strong business case for investment in Finance automation. This will allow Finance to develop additional capabilities needed while retaining the emphasis on recording and reporting, but with an enhanced degree of data accuracy. CFOs need to develop a plan that enables them to recognize both the short- term benefits and the long-term gains.

The opportunities created by the range of emerging technologies require that the Finance function develop its own technology roadmap, which should be aligned to the overall organizational goals and facilitate the development and implementation of the tools necessary to support the overall business goals.

Six Imperatives for Tomorrow’s Finance Function

The core elements of people, processes, technology and data thread through all business activities. Addressing each of these within an organisational culture that supports innovation and creativity is important for harnessing emerging technologies. There are six imperatives for success to build a coherent and logical programme for technology adoption:

1. Align the strategy – understand the organisation’s wider goals and how Finance, using technology, can best support these ambitions.

2. Build the business case – identify the business case for using specific tools and solutions.

3. Appreciate the value of data – explore how CFOs can make better use of data and analytics throughout Finance and beyond.

4. Manage the organisational impact of technological change – identify the organisational change required to embed new technologies successfully.

5. Focus on talent and skills – equip the organisation with the people and skills base needed to exploit the technology.

6. Assess the impact of technology on governance and risk management – ensure that investments are made with rigour and that the risk created by new technologies are properly monitored and controlled.

Align the Strategy

Technological advances are affecting most aspects of organisations – from the use of robotics on the factory floor to the use of customer data through profiling to create additional revenues. A technologically driven organisation is one that needs to understand its business drivers and be able to react rapidly to changes.

CFOs first need a vision of how Finance can create new value in the context of a wider business strategy. That vision forms the basis of the investment case for new technologies and helps Finance agree the working priorities it needs to achieve its desired future state. This process inevitably requires Finance to reach out to other functions and to work more collaboratively – an initiative which can be supported by the adoption of cloud technologies. Reaching out to the rest of the business will also be crucial in understanding what data and analytics the business expects from Finance. By aligning Finance with the business, CFOs can use technology to inform and actively shape the business’s strategic direction. For example, CFOs who use analytics to combine Finance data with other data sets will understand market trends better and be well placed to play a more strategic role.

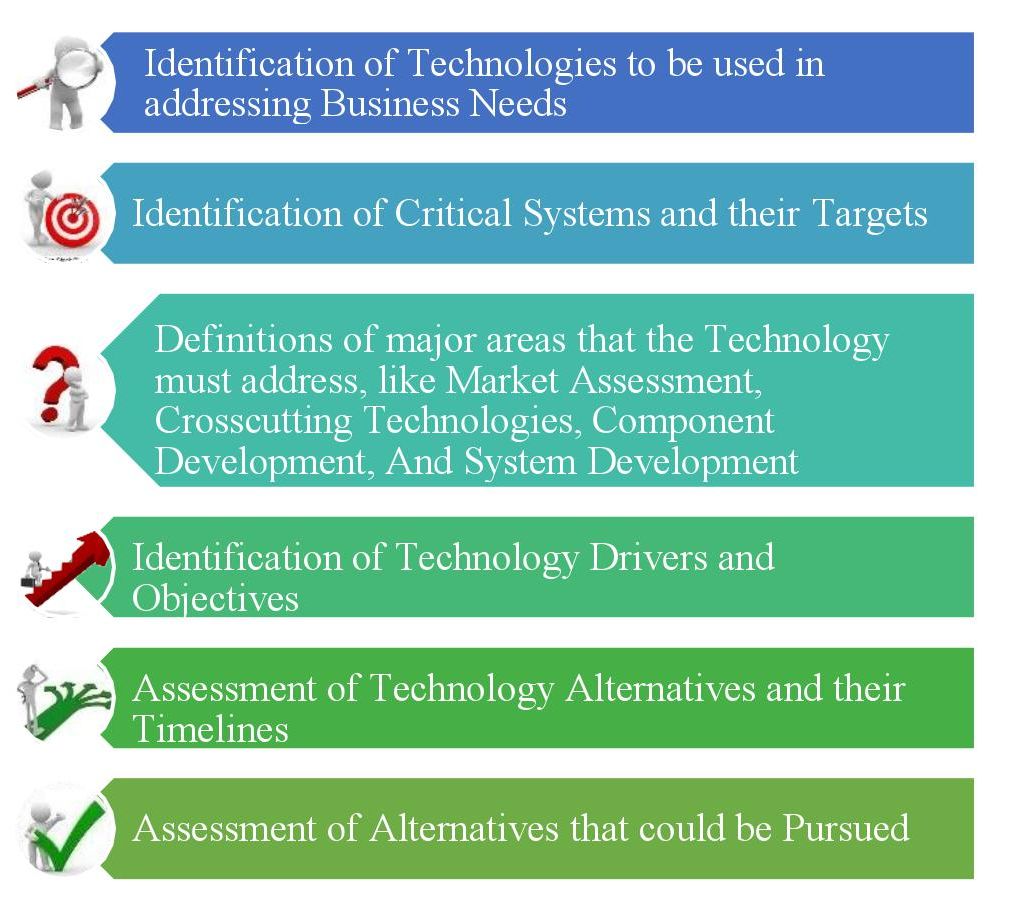

The opportunities created by the range of emerging technologies require that the Finance function develop its own technology roadmap, which should be aligned to the overall organizational goals and facilitate the development and implementation of the tools necessary to support the overall business goals. The roadmap needs to look forward while recognising that the adoption of technology is often a process of continual change. It involves many components, some of which are more mature (such as analytics) than others (such as artificial intelligence). It should also be practical and relevant to achieving the Finance function’s contribution to the organisational goals.

The roadmap should include the following components

Adopting new technology needs to be a high priority for finance... (to)... speed up decision making and make processes more efficient, and ...help the Finance heads to establish a value case for the function itself.

It is important to understand the ‘tipping points’ in the various technologies as the organisation grows.As an organisation grows there are crucial points where it is necessary to migrate from one level of software to the next. When these occur, the CFO needs to recognise the impact on the data requirements of the organisation and in turn the impact on the performance reporting processes. This element was explored by ACCA in partnership with a worldwide association of accountants and financial professionals in business and published as ‘The CFOs Guide to Technology Roadmapping’, which is a report on application of a technology roadmap.

It is important to invest in Finance teams so that they understand the value of the data assets of the organisation and how these may be used to assist in decision making. CFOs need to ensure that their Finance teams are best placed to unlock the potential of the data captured, generated or collected as part of its function. This rich picture provides the greatest insight into organisational performance. The data-flows need to be usable in supporting the ability of the organisation to monitor its performance against its strategic goals, using an effective and efficient performance measurement process.

The use of analytical tools, often with enhanced data visualisation, opens up more opportunities for achieving value. Analytics can also help companies to see patterns in their data that enable them to predict issues before they happen, instead of being forced to react to them after the event. It speeds up finding answers to problems, eliminating data silos and ‘democratising’ data itself. It creates insights that are simple to digest in a short space of time. Making the most of analytics requires a change in mindset.Compared with traditional finance, analytics is a fundamentally different way of working.

However, data needs to be fit for purpose for the systems in which it is employed. Data mapping is an essential activity for understanding data flows and assisting in the management of cyber risks and data- protection requirements, resulting in the development of new business services and improving response time for the Finance function.

Organisational Impact of Technological Change

For the business to benefit fully from technology, the CFO needs to drive implementation with strong and consistent leadership. It is essential, for example, to engage users early if the CFO is going to gain their buy-in, provide reassurance and expedite change. Many in the Finance function feel threatened that technology adoption will potentially lead to job losses. CFOs will need to confront this issue early in the process.

The implementation of technologies such as Robotic Process Automation (RPA) will make changes in the way that organisations are structured. People tend to be comfortable with role-based structures, but RPA focuses on tasks. This can have an impact on the performance management of individuals, who may need incentives for working with virtual workforce.

Finance function is likely to need different types of talent at different stages of technology implementation... (the)...function needs to equip itself with new skills, whether by up skilling, reskilling, or by recruiting externally.

With new technology come new risks and new procedures. Staff would need to undergo up skilling/reskilling. A more outward looking approach to Finance will be necessary, both internally and beyond the enterprise – social media, for instance, may play a part in that. These changes will need to be handled sensitively and effectively, as part of an effective change management programme. Change will also open up new opportunities for those who wish to take them, as Finance ‘moves up the value chain’, partnering with operational teams to increase its relevance.

Transformation initiatives are now focused on efficiency and effectiveness across the Finance function rather than being necessarily a cost saving issue. And effective use of technology will certainly require rigour and robustness in processes; if the process is broken, technology is not going to fix it without addressing the fundamentals of the process itself. For instance, adopting cloud- based applications enables teams to operate across geographies. If the processes are not standardised across these multiple geographies, RPA cannot be implemented to reduce time- consuming and repetitive processing tasks. Modifying the processes to fit the technology model is far easier than trying to customise the technology.

Focus on Talent and Skills

For today’s technology enabled working practices, the Finance function needs to equip itself with new skills, whether by up skilling, reskilling, or by recruiting externally. Some of these skills, especially those supporting data analytics, may not be among those traditionally associated with Finance. Take for example, a report on future skills mix, in ‘Professional Accountants – the Future, Drivers of Change and Future Skills’, which underlines the relevance of various quotients relevant to the finance function of the future.

The use of technology may require a complete reassessment of the skill sets of those across the Finance function. To determine the skills mix needed, the CFO needs to be conversant with the available technological options. John Ashworth, SVP Finance Operations, Smith & Nephew, says “Finance is going to have to invest in people. You need to recognize that there are people with new and highly prized skills coming onto the market whom you need to go out to acquire – data analysts and data scientists”.

Finance function is likely to need different types of talent at different stages of technology implementation. At the same time, CFOs must be aware that skills shortages in certain areas will make it tough to recruit. Rather than repurposing existing staff for these roles, it will often be necessary to cherry-pick the skills required from outside. CFOs need to develop a clear understanding of how their talent needs will evolve in the future as their technology strategy is adopted.

An additional complication is that the technologies of tomorrow – such as quantum computing and blockchain – will drive the need for a new wave of skills. Filling the skills gap for today’s emerging technologies is essential and is not a one-time activity.

Governance and Risk Management

The application of technology is often organisation’s one of the most significant business risks. At the highest level, governance is needed for the strategy and enterprise risks related to technology investment. It is important to have a mechanism for informing the board so that they have oversight. The board members too should review their own skill sets and consider bringing in additional resources to enable them to carry out their responsibilities appropriately. CFOs also need to be clear about the legal and procurement risks of new technology, and they will need to have the right resources in place to address these risks. Contracting for these emergent technologies is not always straightforward. Advice should be sought from those with expertise in these fields.

CFOs who embrace new tools and technologies have hugeopportunity to put finance at the centre of their enterprise’s value creation. Failure to do so will risk the future value that finance can achieve.

Scenario planning and simulation are effective tools in managing inherit risks and in identifying changes in procedures and policies, enabling better management when a crisis occurs. The use of emergent technologies and enhanced risks of evermore sophisticated cyber attacks mean that the scenario plans need to be more encompassing and complex. CFOs, as senior leaders and members of the board, have a responsibility for ensuring that these risks are managed appropriately.

Where data is concerned, governance also means ensuring that the Finance function has a single source of truth. While businesses are focusing on the efficiency and insight that new technology can give them,it is also vital that CFOs don’t lose sight of the importance of internal controls as part of a governance framework. These controls may need to be updated with each new technology. For example, when firms adopt the cloud and analytics, it is important that they identify data owners and establish and monitor the appropriate internal controls.

No Time for Complacency

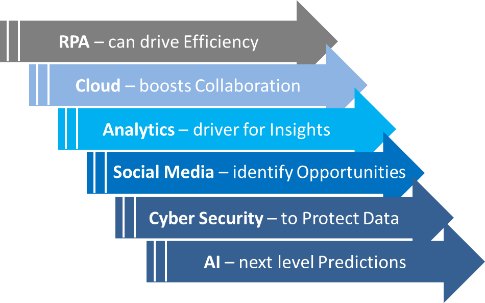

Making the best use of new technology requires a significant change in the mindset. “I think people in this profession should really go beyond their traditional territory. Simply knowing the existence of Finance robotics isn’t enough. They should go into these  technology companies, and fully understand the benefits of all other technologies,” commented Jerry Shu of Accenture Operations in China. Making the best use of new technology requires a significant change in the mindset. In future, we can expect to see radical change as commercial applications running on next-generation technologies such as quantum computing are released into the market. CFOs need to adjust the way in which they operate – from adopting training and change management programmes, to revisting existing governance controls. A CFO should consider the impact of the following key technologies on the Finance function:

technology companies, and fully understand the benefits of all other technologies,” commented Jerry Shu of Accenture Operations in China. Making the best use of new technology requires a significant change in the mindset. In future, we can expect to see radical change as commercial applications running on next-generation technologies such as quantum computing are released into the market. CFOs need to adjust the way in which they operate – from adopting training and change management programmes, to revisting existing governance controls. A CFO should consider the impact of the following key technologies on the Finance function:

CFOs who embrace new tools and technologies have a huge opportunity to put Finance at the center of their enterprise’s value creation. Failure to do so will risk the future value that Finance can achieve.

Extracted from ACCA’s report – Race for Relevance: Technology Opportunities for the Finance Function, released in December 2017

ABOUT THE AUTHOR

ACCA (the Association of Chartered Certified Accountants) is the global body for professional accountants,offering business-relevant and first-choice qualifications to people of application, ability and ambition around the world who seek a rewarding career in accountancy, finance and management. ACCA supports its 198,000 members and 486,000 students in 180 countries, helping them to develop successful careers in accounting and business, with the skills required by employers. ACCA works through a network of 101 offices and centres and more than 7,291 Approved Employers worldwide, who provide high standards of employee learning and development.Through its public interest remit, ACCA promotes appropriate regulation of accounting and conducts relevant research to ensure accountancy continues to grow in reputation and influence. Founded in 1904, ACCA has consistently held unique core values: opportunity, diversity, innovation, integrity and accountability. It believes that accountants bring value to economies in all stages of development and seek to develop capacity in the profession and encourage the adoption of global standards. ACCA’s core values are aligned to the needs of employers in all sectors and it ensures that through its range of qualifications, it prepares accountants for business. ACCA seeks to open up the profession to people of all backgrounds and remove artificial barriers, innovating its qualifications and delivery to meet the diverse needs of trainee professionals