INVITING APPLICATIONS

14th SSF EXCELLENCE AWARDS & RECOGNITION – 2025

LAST DATE: JUL-25 | APPLY NOW

There is enough and more being spoken and written about big data and analytics. But the fact and truth around all this hype is that very few have got it right - in terms of having a clear thought- through strategy on how it will help and drive value for them and if it will, how should they go about executing and institutionalizing the practice in their organization, across functions.

Although digital (Data Analytics, Technology, Mobile) adoption across industries has been widely discussed, the Business Process Management (BPM) and Shared Services industry has been trying to catch up while adapting to the full impact of digital transformation. However, any large cross functional SSC/GIC/GBS is best poised to leverage analytics to drive significant value for the business.

Unfortunately, there is no cookie-cutter approach. This article addresses why big data analytics is not widely institutionalized even though we all know it creates value.

More often than not, disruption or transformation is primarily driven by a creative idea that challenges the status quo or provides a radically different way of doing the same thing with technology and analytics as mere enablers.

A few observations on what’s plaguing deployment of analytics in the Shared Services/ GIC /GBS:

- Too much granular data, but limited clarity and creativity in defining business problems. Most senior leaders and large organizations are grappling with defining the right problem statement and subsequently, translating large amounts of available data into appropriate answers. It’s truly a case of “water, water everywhere, but not a drop to drink.” Most large organizations today have petabytes of consumer data but are unable to articulate specific problems and make effective use of that data to address them. While questions like improving forecast accuracy or promotion analytics or Market Mix Modeling are straight forward, the real juice is in helping drive Revenue and Market Share up through a focused problem definition.

For instance, “why am I losing share in X Brand in Y Geography” or how does millennial behaviour impact my sale of brand X in metros?’ - Expectations for quick ROI instead of opportunities for possible disruption. Organizations sometimes choose a quick fix over a long-term, far-reaching disruption of customer experience or 10 x improvements. Steeped in traditional evaluation measures organizations remain averse to change, with a complete lack of ability to innovate and take calculated risks. More often than not, disruption or transformation is primarily driven by a creative idea that challenges the staus quo or provides a radically different way of doing the same thing with technology and analytics as mere enablers. Organizations that achieve this level of disruption are led by exceptionally strong visionary leaders, such as Jeff Bezos’ @Amazon and Elon Musk @Tesla Motors, each driving innovation and demonstrating the willingness to forge futuristic change to achieve success.

- Disconnectedness among those who understand business process, technology, and analytics. It is not unusual for someone who is adept in statistical modelling to not understand the business context of the data being evaluated. An organization may have data scientists who work on projects, but what value do they bring if they do not solve a real business need? The same is true for technologists who can eloquently detail the advantages of natural language processing but cannot understand how it can be applied to business processes, operations, products, or services.

- A good algorithm... badly executed. There are also instances where the business problem is well formulated and the ROI is clear. However, actions that need to be taken at the last mile to realise the benefits are not well executed.This is often due to lack of alignment in the goals of various members in the organisation with different vectors, each moving in their own direction.

A Case Study on Predictive Analytics Driven By the SSC

Here is an example of how Hindustan Coca- Cola Beverages, a leading FMCG company, is embedding analytics with real impact through its shared services. This company has a large shared service & runs end- to-end process in Finance, Procurement, Supply chain, Sales Operations, Commercial, and Human Resource. It has an Analytics team that supports across these functions and is truly embedded in them.

The Analytics team’s core role in this Shared Services centre is to:

The beverages business in India has millions of retail outlets that are required to be serviced. The product being an impulse purchase has to be always available. A retailer who lets business go is lost business. Attrition of retailers has both immediate and long-term financial and strategic impact to the company. It was therefore imperative to understand the key drivers of the inclement customer behaviour at large and work proactively with retailers who were at great risk of leaving the business.The Sales Operations team needed to be provided a solution to proactively stall the current trend of attrition and bring in growth at the retail outlet level.

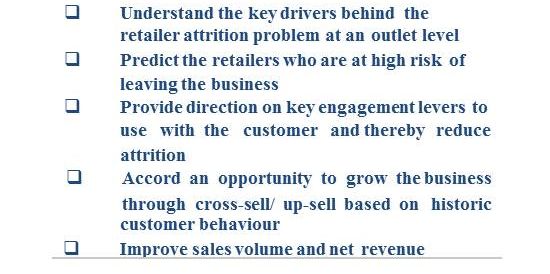

The analytics team was tasked with the below outcomes to improve the current customer – that is the retailer – engagement process:

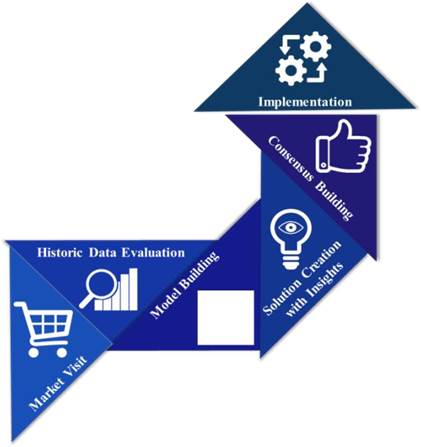

The analytics team worked on a project using advanced algorithms to proactively prevent revenue loss by Identifying retailers who are likely to attrite from the business. The approach followed had following phases:

✓Market Visit

✓Historic Data Evaluation

✓Model Building

✓Solution Creation With Insights

✓Consensus Building

✓Implementation

Building the Model

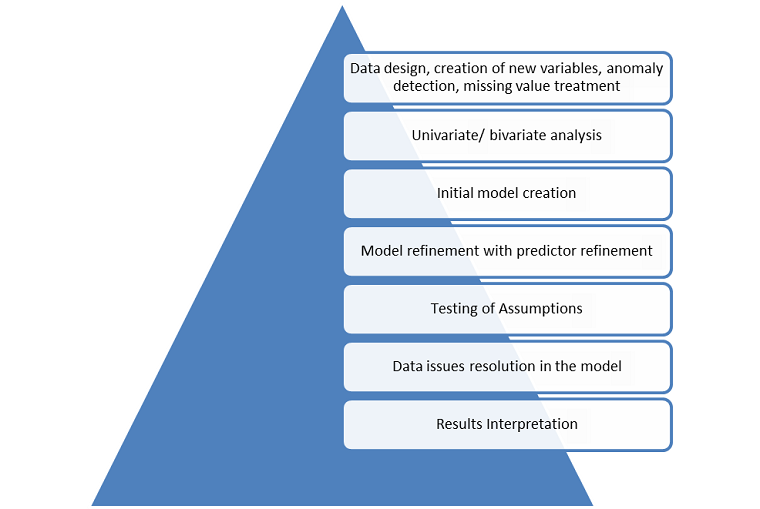

As a first step towards the model creation, historic data across 3 years was evaluated for the several thousand retailers in a test town across various performance parameters. The model creation objectives were quantifying attrition drivers based on customer behaviour and identifying customers with the risk of attrition. The team took the data through the data through the various phases of model creation including.

Key Insights

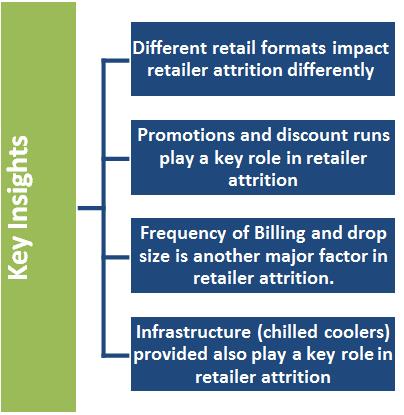

The results provided several valuable insights both at a market level and at a customer level:

Implementation

Like in most FMCGs the sales executives, use a touch-screen powered hand held device to take orders.Granular level insights were made available to the sales executives through their hand held device. Sales executives were able to accurately assess the degree of risk associated with the individual retailer they were engaging with as High, Medium and Low risk of attrition and corresponding actions by the retailer.

Value-Add to Business Results

Retaining customers (retailers in this case) is key to business growth. Hence proactively identifying who is likely to attrite our business is a huge enabler for growth. The model was able to predict with 85% accuracy the retailers who are likely to leave the business.

The Operations team developed customer retention plan for all the high-risk retailers, by proactively engaging with these retailers, significant sales runoff was prevented.

The following therefore contributed to the success of embedding analytics and driving value:

Conclusion

Institutionalizing Analytics across functions can be a huge competitive advantage for an organisation as this case study shows. Like these, there are many areas where simple analysis to predictive modelling can be applied for enhancing customer experience and driving value for an organisation. Key is in framing the problem well, having the right business plus statistics domain knowledge and collaborating well with the user on the ground at every stage of the process.

ABOUT THE AUTHOR

Tanmay Agarwal comes with more than two decades of rich cross functional experience in Supply Chain, Finance, Commercial & Business Head roles at operational and strategic levels. He is currently leading the Global Business Services at The Coca-Cola Company. He is known for his pioneering initiatives taking processes to the next level of performance through the rigor of operational excellence, strategic influencing and team alignment. His strong business acumen and leadership, end to end Supply Chain, Financial Management & Commercial skills make him entrepreneurially committed, defying conventional wisdom, using ideas that work well and adapting them to achieve growth. He is known to envisage major opportunities and to decisively turn these into significant long term business benefits. He has a passion for growth and change – sets challenging, stretched goals, achieving results through focused drive,team leadership and alignment.

Ask an Expert

Ask an Expert