INVITING APPLICATIONS

14th SSF EXCELLENCE AWARDS & RECOGNITION – 2025

LAST DATE: JUL-25 | APPLY NOW

Finance as a role has come long way. The word ‘Finance’ originates from the French and is subsequently adopted by English-speaking regions to refer to the ‘management of money’. ‘Finance’, today, is more than just a word; it has emerged into a highly significant professional and academic discipline focused towards not on managing all forms of corporate resources, but also defines new age thinking towards capital and pricing theories, procurement and inventory management structures, corporate asset administration and manpower utility and assignment programs, amongst others.

Modern decision-making financial theories developed largely in the mid-1950s, where the Finance organization’s sole aim was to achieve optimal use of the limited financial resources. The scope of finance was mostly confined to the procurement of funds by business houses to address financial needs. As the demand for funds continued to increase rapidly, episodic events including liquidation, merger, acquisition and consolidation became an integral part of the finance function.

Global financial debacles such as the Great Depression led by the stock market crash and the more recently Lehman Brothers bankruptcy led world recession has increased the emphasis on keeping a strict vigil on the three C’s of finance – Compliance, Cost and Control. Further, a number of factors such as the rapid technological advancements, intense competition, growing population, industrialization and government interference have contributed to the increased focus on the effective and efficient use of scarce financial resources. This shift from episodic financing to managerial financing is another visible pointer to the emergence of finance as a function.

Technologies like Big Data, AI and Robotics are driving business into what is

called the 4th Industrial revolution.

Modern finance extensively leverages technology across all accounting and finance processes for enhanced performance as well as for strict adherence to the three C’s. By using high end technology applications, Finance as a function is able to take a broader view on various business aspects, including profitability planning, determining the asset mix, risk analysis, optimal capital structure, financing, investment and dividend decisions as well as the direction of business growth.

Business is Changing

Technology has changed the way business is being done. The risk of being “Ubered” is driving lot of changes in the way businesses are being restructured. Few years ago technology was primary used to automate and improve efficiency in support functions like HR and Finance. But now, technology is inextricably embedded in business whether its self-driving cars such as Tesla or aggregators like Airbnb. This wave of transformational change is termed as ‘digitization’.

Digitization is widely seen as a competitive necessity. A majority of senior leaders acknowledge it is far more than just a source of efficiencies—it is an essential requirement for survival. Changing customer and employee needs and behaviors, in addition to the emergence of new business models make older ways of working and delivering products and services far less attractive. Technologies like Big Data, AI and Robotics are driving business into what is called the 4th Industrial revolution.

Finance as a Function is Evolving

As the demand and expectation from Finance changed gradually over a period of time, the role of the function too has evolved.

With the introduction of highly trained finance professionals and availability of advanced technology applications, Finance as a function has now moved:

- From Accounting to Analyzing

- From Schedules to Structuring

- From Ledgers to Dashboards

- From People to Processes

- From Rationing to Optimizing

- From Controlling to Enabling

From a position of an associate merely reporting numbers, Finance has transitioned itself to a position of a partner to the business and created technology driven specialist centers such as shared services by heavily leveraging the features of advanced ERP systems and robust connectivity.

The CFO’s New Role in the Digital Era

The role of the Finance leader in enhancing both customer experience and business possibilities pivots between being an advisor and an enabler. The advisor focuses on financial impact and controls. The enabler, on the other hand, works with the organization to coordinate all the strands of insight, development and launch needed to bring new customer experiences to market quickly and successfully.

Finance is doing things that it never could before – thanks to digital technologies. End-to-end multi-dimensional data access is enabling total visibility into both enterprise and customer data. As a result the finance organization has evolved from an expense control, spreadsheet-driven accounting and reporting center, into a predictive analytics powerhouse that creates business value.

Finance in the digital world – or tomorrow’s digital finance organization — is a radical departure from the status quo of the past. It deals in analytics and forward-looking decisions to create value and manage risk. It shifts traditional accounting and processing to cross-functional integrated business services models that uses Robotic Process Automation and Artificial Intelligence as its basic service blocks. It trades reporting the past for predicting the future. As this model takes hold, the role of the CFO too is changing. In addition to their traditional roles, CFOs are dealing with hugely complex legacy systems and their integration with new ones, continuously changing business and internal environments, managing the diverse needs of stakeholders, new and unknown business risks, and supporting increasingly complex operating models.

New Role of Finance in Digital World

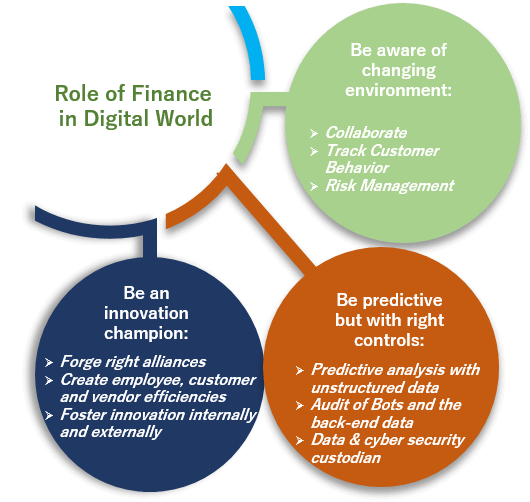

This juggernaut called digitization has upset the apple cart of every role and function in the organization and life in general. Functions hitherto called “support”, such as HR and Finance are now taking centre stage within the organization and bringing in the much-needed professionalism to create competitive advantage. The role that Finance now plays is a lot more strategic than mere bean counters and fund managers. In the new regime, the traits that this function is expected to demonstrate are:

- Be agile and be aware of the changing environment: This is arguable the most important feature that Finance must demonstrate. Understanding the nuances of the business is essential to be of value. Some of the activities to remain agile could be:A.1 Collaborate ‒ To ensure that Finance understands business and works with the business partners to design rights solutions around possible business models considering the market situation, competition and risk management.A.2 Track Customer Behavior ‒ Through channel partners, social platform to generate new opportunities/ leads for business from existing customers. Personalization is a big trend and this needs to be tracked at customer level and for a segment of customers to ensure customer satisfaction.

A.3 Risk Management ‒ Tracking competition, Project overruns, pricing and predictive analysis to secure top line and improve bottom-line.

- Be predictive but with right controls: Keeping the organization ready for the future and provide meaningful actionable information is important, but this comes at a risk. It becomes the task of the Finance function to ensure that the risks are well managed with the right controls. A few tasks under this group are:B.1 Predictive analysis with unstructured data ‒ Finance is best poised to combine enterprise data with finance data and also combine this with unstructured data from various sources such as call centers, social campaigns and social websites to provide meaningful information to business to drive budgets and forecasts.B.2 Audit of Bots and the back-end data ‒ Automating finance and enterprise data is a given but Finance should develop data scientists who should continuously audit these new-age technologies to ensure that the organization gets the desired results, improves continuously and minimizes exposure.

B.3 Data and cyber security custodian ‒ Establish right data governance and ownership is very important in a data driven decision-making world. Having right cyber security strategy to prevent cyber-attacks is equally important. A role of Chief Data Officer could well emerge as part of the CFO organization.

- Be an innovation champion: Finance should take a lead role in identifying, refining and supporting innovations within an organization and become transformational leaders to create enterprise wide innovation culture. The function must:C.1 Forge right alliances ‒ Strategic alliances are a well-established way of creating specialization & include much required skills. Mergers & acquisitions, especially with start-ups with niche skills are disrupting business, especially in Finance Services industry. Finance function should ensure that business does the right alliances with proper commercial and revenue sharing arrangement to secure a sustainable growth for future.C.2 Create employee, customer and vendor efficiencies ‒ All-round improvement can be brought about through conversational interfaces using bots AI and social technologies. Finance should also track these interfaces to develop meaningful information for the organization.C.3 Foster innovation internally and externally ‒ extensive use of new technologies to provide new insights both internally and externally. For instance, new bolt-on tools on top of ERP to provide deeper analytics to the business partners, or keeping customers engaged with continuous product improvements in partnership with business.

A New Mindset

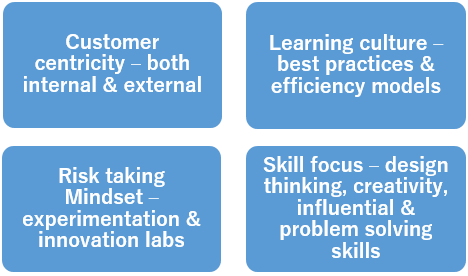

It is not so much about future of Finance, but more about Finance of the future. It is this mindset that has to be created within the finance professionals today to be able to provide value to the larger organization. Professionals need to create an inclusive environment of:

The world over, Finance is all-set to take on the role of a nodal agency for change and decision-making in all spheres of business. The leaders just need to create the extra push internally and use the available technologies extensively and judiciously.

ABOUT THE AUTHOR

A professional with 20 years of experience in the areas of Finance Transformation, Accounting and Finance, Shared Services Management, Financial Process Management, ERP implementation and Audits. Proficient in managing & leading multiple teams for running successful finance operations & experience of developing standard, industrializing processes for business excellence.

A keen strategist, innovator and a self-starter in managing independent operations & ensuring optimal utilization of resources with reporting to multiple senior stakeholders in matrix structured organizations.

Ask an Expert

Ask an Expert