We live in an era of instant gratification. Everything we need has to be delivered on demand –anytime, anywhere we want it. Financial services are no different. As Internet and smartphones increasingly facilitate real-time payments, fund transfers, settlements and other financial transactions, customer expectations from their banks, insurers and mutual funds continue to evolve rapidly.

…the conventional BFSI IT architecture will have to be reengineered for the

industry to effectively serve the needs of the millennial generation.

If a bank’s customers are not engaging with its latest app release, then it must harness user feedback to plug the gaps and roll out a revised, improved version at the earliest. If the mobile banking and Internet banking channels are currently displaying different customer data, then that bug has to be fixed quickly. And so on and so forth. A failure to effectively address customers’ queries, and act on their feedback, can lead to increased client churn and diminished brand reputation.

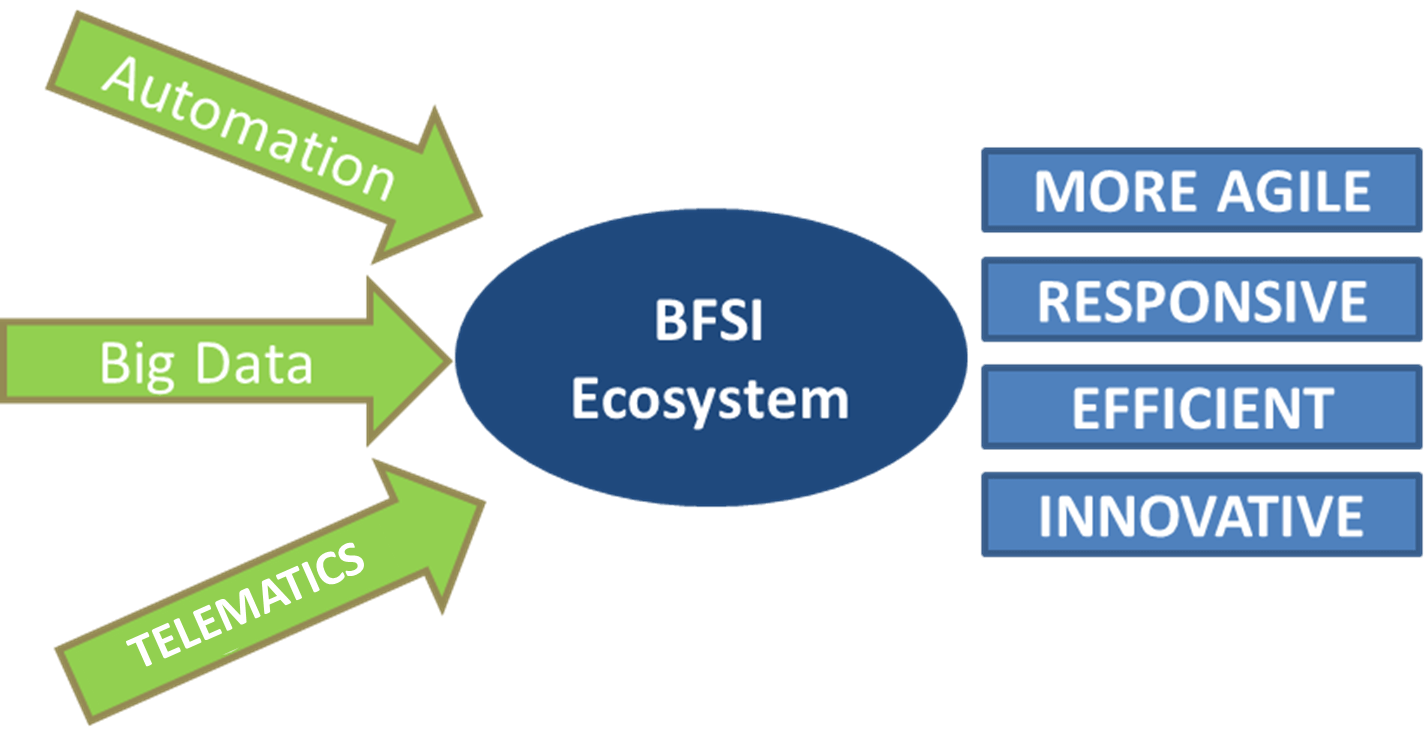

With disruptive trends such as consumerization, automation, Big Data and telematics fundamentally redefining the Banking, Financial Services and Insurance (BFSI) ecosystem, financial institutions must become more agile, responsive, efficient and innovative. BFSI companies need to build new capabilities, adopt new ways of working, embrace new workspaces, and above all, develop a completely new mindset with regard to operations, customer service and other core functions. Just to put this imperative in context, banks today are focused on delivering compelling and consistent Omni-channel experiences, complying with regulation, averting fraud, and reducing costs.

However, over the next 10 years, banks will have to also establish themselves as credible repositories of customers’ trust, and provide real-time and secure services in an automated and integrated manner.

Need to Reinvent Digitally

Accordingly, the conventional BFSI IT architecture will have to be reengineered for the industry to effectively serve the needs of the millennial generation. The good news is, BFSI firms recognize this pressing need for digitally reinventing themselves, and have been aggressively leveraging technologies such as artificial intelligence, blockchain and the Internet of Things (IoT) to create differentiated customer experiences. Every financial institution is reimagining its IT model from the grounds up.

However, orchestrating this transition is easier said than done, since many of the sector’s legacy systems lack the requisite flexibility to accommodate new functionalities. Also, stringent regulations do not exactly smoothen the process for BFSI firms to partner with non-financial institutions across various industries, for enabling on-demand customer experiences.

I firmly believe BFSI companies need to embrace a fundamentally “NEW IT” thinking, across the following dimensions:

The New IT Service Delivery Framework

In order to navigate this transition smoothly, financial services firms need to adopt a new IT service delivery framework that is based on the four pillars:

The framework should foster rollout of Agile and DevOps methodologies for accelerated software delivery, helping the organization reduce time to market for new products and services. For facilitating increased collaboration within and outside the organization, the architecture must enable the institutionalization of a common, integrated workspace for various stakeholders within BFSI companies. For example, banks should be able to leverage the framework to tie up with universities, fintechs and third parties for ideating around and developing cutting-edge solutions. To ensure rapid innovation, the framework also needs to help banks smoothly align themselves with cutting-edge tools and technologies, such as cognitive systems, artificial intelligence, machine learning, blockchain and Big Data. Finally, for ensuring robust IT governance, the framework should adopt an operating model that’s built on real-time reporting and flat organizational structure.

The AGILE Proposition

So, how can financial institutions begin implementing such a framework?

In Summary

All in all, I feel we have barely scratched the surface of the BFSI IT architecture re-imagination landscape. Banks, insurers and other financial firms need to use this transition period to quickly test out or revise some of their hypotheses, and accordingly build new systems. And, I am confident the industry will significantly enhance its value proposition in the coming years by adopting a next-gen IT framework that makes them more efficient, productive and effective.

ABOUT THE AUTHOR

Rahul Singh is President of HCL’s Financial Services Division. He is responsible for managing and steering the business, developing relationships with clients and taking long-term investment and strategic decisions to meet the technology and operation needs of the financial services and Fintech clients.</em></em>Rahul brings with him over 30 years of experience across outsourcing, technology, banking and financial services. He is widely recognized as an industry pioneer in the Business Process Outsourcing (BPO) segment for financial services in India and has been the recipient of SSF’s ‘Pioneer BPM Achiever’ award in 2016. He is now an authority on the impact of the Fourth Industrial Revolution on financial services. In 2018 he was invited by the World Economic Forum in Davos to present his thoughts on innovations and emerging opportunities in the investment industry to a select group of CEOs, bankers and technology leaders.

Ask an Expert

Ask an Expert