INVITING APPLICATIONS

14th SSF EXCELLENCE AWARDS & RECOGNITION – 2025

LAST DATE: JUL-25 | APPLY NOW

Futurist Thomas Frey says that Business will change in the next 10 years much more than the past two decades, and humanity will change in the next 20 years more than in all of human history. As per Frey, by 2030, the average person in the US will travel 40% of the time in driverless car, use 3D printer to print hyper individualized meals, and may be, 50% of today’s Fortune 500 Companies would have dropped off the list.

Like the tip of the iceberg, the roller coaster changes of 2030 are visible in today’s global environment through unprecedented forces of change happening simultaneously in US/UK.

These changes are impacting businesses of several global corporations and thereby, having a direct impact on the Global Business Services, the strategy that was initiated as captive centres, two decades back.

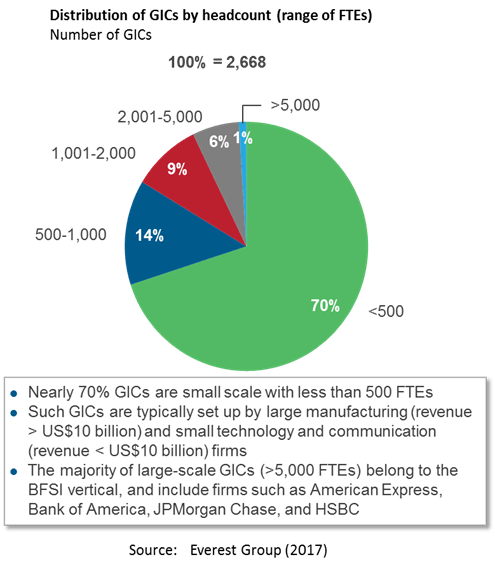

Offshoring to India is anchored in mid 90s as a pioneering strategy by American Express. It was based on the early fruits of technology enablement, as an in-house captive centre, now renamed as Global In-house Centres (GICs). There has been significant growth over the last 20 years – 2600+ GICs, 50% in India itself – not only in number of FTEs but also from low-end transactional processes to high-end and analytics processes. Nearly 70% of the GICs are small scale centres i.e. less than 500 FTEs (see chart below) of large manufacturing corporations and mid-size companies.

While the fundamental construct of the GICs has been as a ‘cost centre’ of the parent company, many of the mature GICs, have made efforts to grow into GBSCs and move up the delivery chain to become ‘value focused centres.’ However, GICs are not often run as a ’business’. Hence, their future readiness to plan and contribute to parent company’s business is contingent upon the information shared with, or perceptions of the HQ, well founded or otherwise. Given this, today we are truly at an ’inflection point’ of GBS centres. There is a need to assess and enable how the GBS Centres can become future ready now, and refresh to re-align their priorities with the parent company’s future business priorities.

Ironically, one clear example in the past that had the ‘readiness’ to deal with shocks of business environment was the GBS centre of Lehman Brothers at Mumbai. In 2008, when the parent company Lehman Brothers filed bankruptcy due to financial crisis, the tenacity and resilience demonstrated by the GBS leadership of Lehman Brothers in India to jump on to the driving seat and direct their own destiny despite the shock of the parent company, is really appropriate and worth a case study by itself.

‘Being future ready’ should be a business need of GBSCs. It should not be at the discretion of a directive from Corporate HQ, especially if the GBS leadership wants to create the right level of positive impact to the parent company and not be negatively impacted by a future shock.

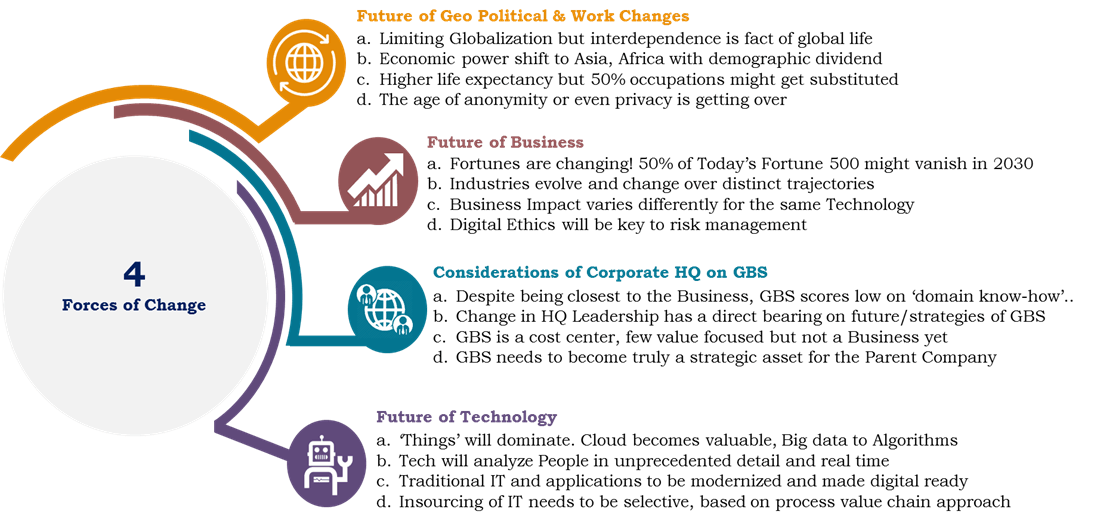

Four Forces of Change for GBS to reckon with:

The GBS Centres need to consciously consider the impact of four forces of Change to assess and build their readiness:

- Future of Geo Political & Work Changes,

- Future of Business Change,

- Future of Corporate HQ philosophy on Offshoring, and last but not the least,

- Future of Technology

Each of the above will have a direct impact on GBSC but the impact could vary from one business domain to another. Consequently, the strategic posture will have to be relevant for the domain they belong to and the responses need to be appropriately incorporated into their future readiness. The key change elements under each force are captured in Chart 1 for brevity and focus:

1. Future of Geo Political & Work Changes

- The certainty once associated with globalization has suddenly come into question with Brexit, the Philippines, Netherlands and France, and of course, US. The interdependence of countries, now a fact of global life, is not matched by strengthening global governance. However, there is an expectation that political and corporate leaders will engage together in the development of what is called ‘human rights ecosystem’.

- Economic power and political power will increasingly shift to Asia - China in particular, and India to a large extent. Africa, with its lowest median age in 2030 (21 years) as compared to Europe (45 years), will have the demographic dividend shifted from India.

- The retirement age will go up to 67 years, with higher life expectancy. Population of millennial will reach a peak by 2030. Liz Bentley says that 50% of occupations that exist today will not exist 10 years from now.

- The age of anonymity or even privacy is getting over, directly impacting the social fabric of the people across the globe.

2. Future of Business

- Fortunes are ever changing! As already mentioned, 50% of today’s Fortune 500 might have changed by 2030. A good indicator of the past experience of business is that 7% of the Fortune 100 in 2007 does not appear in the Fortune 500 of 2017; only 12% of the Fortune 500 companies in 1955 remained Fortune 500 in 2016, and 50% change happened between 2000 and 2016 - thanks to digital transformation. Out of many, there are several oft quoted examples such as Lehman Brothers, Kodak, Blockbuster, Sears and the like.

- Industries change in different ways. An HBR article summarizes that Industries evolve and change over distinct trajectories – radical, progressive, creative and intermediating, across two dimensions – core activities that generate profits and core assets that represent the resources, knowledge and brand that have made the organization unique.

- The key highlight to focus between Business & Technology is, for the same technology, the business impact varies very differently for different businesses.

- For example, IoT is transforming six industries – Agriculture, Healthcare, Retail, Transportation & Logistics, Utility and Manufacturing – very differently, and the challenges of one business like Agriculture varies from the challenges for the other, like Manufacturing.

- In the business world, demand is increasing for a new, trustworthy source of information on tax and regulatory changes worldwide, to drive global as well as local decisions, through effective use of the advanced technologies. On the same count, hence, Digital Ethics will be key to risk management.

3. Considerations of Corporate HQ on GBS

- The expectations of corporate HQ from GBS are changing and the Net Promoter Score (NPS) of GBSCs is not very encouraging. As per the Bain - NASSCOM

- 2017 study of India GICs, NPS is at a low of only 17%. While this is an external report, many GBSCs do not take VoC from their internal customers. Hence, they are mostly unaware of the NPS. Despite being closest to the business, one particular reason of HQ’s perception of low performance of GBS is ‘domain know-how’. This requires substantial effort from GBS to make a difference in the future.

- Leadership change at the HQ for GBS or even at the Parent Company CEO level, has a direct bearing on the future and strategies of GBS. A good example is Aviva Global Services. It started off as a model BOT structure with 3 vendor partners and 6 centres. With a change in top leadership, it became a pure outsourcing operation, after 3 years of BOT Operations.

- GBS is seen as an extension of business of the parent company. While one welcomes this construct from GBS value creation/ business point of view, it has a few downsides to it that affects the very DNA of the GBS. Firstly, this is the key reason for GBSCs to be looked at as a cost centre. This approach leads to inherently higher costs. The comparison is often with what is prevailing in the parent company and not with what is prevailing in market place competition (like BPO majors). Second, by design GBS is financially managed by cost budgets and not by profitability of a business. Value delivery is also not properly measured in a ’demonstrable’ manner.

- Pioneering leaders of GBS like American Express, P&G etc., have always set the goal for the GBS to become truly a strategic asset for the parent company. Strategic Asset is a specific set of core capabilities and resources that an organization possesses. They provide the organisation a significant and unique competitive edge to sustain its future outcomes and continue to grow and prosper. This continues to be a dream for many of the GBSCs, as the strategic connect is relatively lower as compared to the expectations of Corporate HQ.

Pioneering leaders of GBS like American Express, P&G etc., have always set the goal for the GBS to become truly a strategic asset for the parent company.

4. Future of Technology

All changes from the forces of geopolitical, social and business have a strong connect with technology, and hence, it is needless to over emphasize the pervasive and rapid change happening due to technology.

- As per Pemberton Levy of Gartner, in 2030, ’things’ will dominate, having grown exponentially. As every product, service and process becomes digitalized, the product ‘cloud’ will become more valuable than the product itself. Competitors will continue to challenge industry boundaries and traditional business models. With IoT and with more than 50% population having internet access, the demands for internet connectivity will substantially go up. In short, digitalization will make the world an even smaller place. With billions of connected devices and things, the business will move beyond Big Data to Algorithms. Obviously, an increasing portion of the workforce will not be human.

- Technology will impact the people in GBS substantially. It will make finding the right talent easier and reduce unintentional bias. Employees will be analysed in unprecedented detail and in real time, to ensure they are effective and happy. Mobile banking will transform the lives of people from emerging countries and will be more ‘empathetic’, thanks to virtual reality. Besides the people skills, data science, forecasting skills and the ability to design and tweak algorithms will be even more essential.

- While there is so much talk about New Age IT, there is another dimension to the technology: legacy platforms as well as multiplicity of applications. Many large organizations deal with as many as 2000+ applications and bulk of them are not digital ready. Companies clinging to out-dated applications eventually run into a problem. BlackBerry, Blockbuster and Kodak are good examples. CXOs are keen to get this sorted out in the next few years, so that the Old Age IT does not become an ‘albatross around their neck’. This will call for disproportionate effort to prioritize and change, while there is continued focus on modernizing IT.

- In the last couple of years, many large BFSI & retail companies have started ‘insourcing’ technology after having outsourced, with the intent to create strategic focus towards New Age IT. While the strategic intent to insource outsourced processes is well justified, this could be a big change for both GBS and corporate HQ. If not managed well, this can put the corporation back by few years in terms of GBS. This needs to be carried out carefully and in a structured manner. Instead of insourcing all outsourced processes, there is a need to segregate the high end processes that require insourcing as they serve the strategic intent of innovation, and allow the low end processes to continue to remain outsourced. However, if insourcing is done due to high cost-to-serve, then the approach is inappropriate. Any IT work that is routine and transactional can remain outsourced – but at a lower cost – by inviting fresh RFPs, as required, for award of the new contracts. The GBS, besides the parent company, needs to be in the forefront to make such insourcing decisions meaningful with strategic analysis backing such a decision.

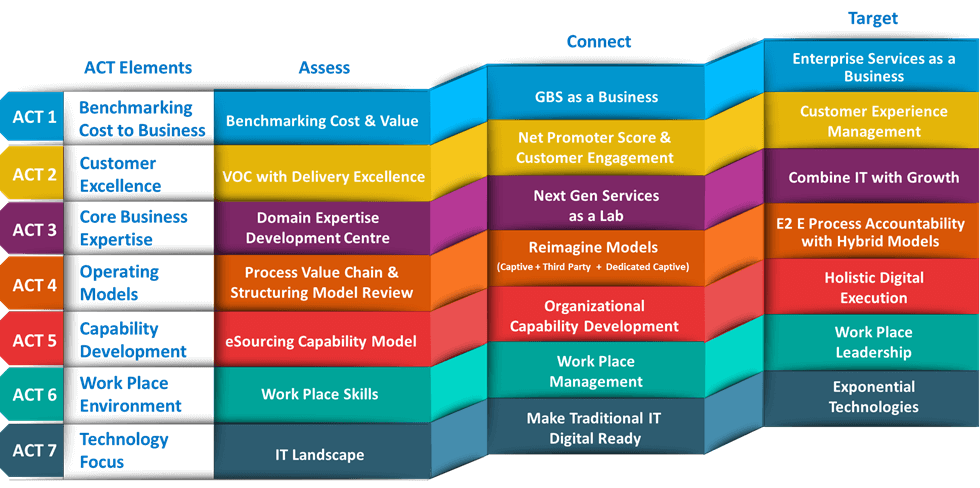

The mantra that will be used for achieving future readiness is ACT – Assess Readiness, Connect Readiness and Target Readiness i.e. ACT now for Future Readiness.

‘Getting Set’ for Future Readiness

The change elements under the four forces of change are by no means exhaustive. They are only highlighting the extent of change possible or happening – few within our control or influence, and many beyond our control. However, it is abundantly clear that GBSCs and GICs need to ‘get set’ for future readiness from TODAY, if they are keen to proactively shape their own destiny. There are SEVEN tracks that need to be worked upon to progress towards the goal of Future Readiness. These form the ‘Seven Tracks of Highly Effective & Future Ready GBS. Each of these SEVEN Tracks of ACT has ‘Assess’, ‘Connect’ and ‘Target’ parameters to follow for enabling future readiness, as captured in Chart 2.

The ‘Call to Action’ is immediate and we need to categorize the actions with a view to eventually target future readiness. One action may address issues under more than one force of change and hence, the actions need to be considered holistically and a framework drawn up accordingly.

Let us look at these briefly. The mantra that will be used for achieving future readiness is ACT – Assess Readiness, Connect Readiness and Target Readiness i.e. ACT now for Future Readiness.

As it evolves, it could be that the future of Global Business Services could well determine the future of the Business itself.

ACT 1 – Benchmarking Cost to Business

(A) Benchmarking of Cost & Value Delivery in the Assess Stage is the fundamental starting point to the journey of getting future ready with a meaningful dollar metric that connects GBS not only within the parent company but also with the comparable external market environment in terms of a sustainable value story. Benchmarking of cost needs to cover Fully Loaded Cost per FTE (FLC/FTE) – including direct and indirect costs. HQ allocated costs are also to be included, while determining the FLC/FTE. Many of the GBSCs report the Budget vs. Actual for Total Direct Costs and not the FLC and do not always establish the FLC/FTE.

This way of working is insufficient for benchmarking, as external information available is always FLC/FTE. Similarly, Value Delivery by the GBS is to be established covering savings, risk mitigates and revenue impact. This Assessment enables to identify the opportunities for cost reduction as well as areas to mine and deliver value for the business.

(C) Post this assessment, the Connect Stage is to progress towards GBS as a business, and surely not remain as a cost centre or even a value-focused centre. This is an important milestone for future readiness. This will require establishing the costs and revenues of GBS as a business through a simple charge-out mechanism along with value of net assets deployed in setting up and running of GBS. This will provide the ROI of GBS and give a real momentum for the GBS to look for opportunities to re-allocate resources as per parent company priorities. As of now only about 10% of the GBSCs actually report as a business, since the general belief is that GBS is an extension of the parent’s core business.

(T) The Target Stage of Enterprise Services as a business, fully aligned to parent company’s priorities is what makes the GBS become truly future ready. Here, the approach is inverted – where the GBS prepares its Strategic Plan based on the parent company’s priorities and challenges and proactively allocates resources towards fulfilment of those requirements. Procter & Gamble GBS is a good case in point for reference, which has already reached the Target stage of ‘Future Ready’ (See Case Study). As it evolves, it could be that the future of Global Business Services could well determine the future of the Business itself.

P&G GBS: Getting Future Ready through NGS - A Case Study*

Procter & Gamble has been the Global Business Services industry’s poster child. Their GBS Model is mature delivering to a global strategy. Two years back, the GBS Leadership believed that the key to unlocking the next stage of value-add lies in ‘leveraging exponential technology disruptors to redefine work processes’, and reimagine GBS service delivery to enable digital business model for the enterprise. In partnership with Singularity, P&G’s GBS set up its own ‘collaborative laboratory’ via a new Next Generation Services (NGS) team, and tapped into the best resources for exponential technology.

The team launched a three-stakeholder group approach to moving forward:

- Exponential Work Processes, represented by each of its service lines

- Exponential Technologies, represented by the top few IT & Shared Services providers and

- Exponential Ecosystem, represented by 200 external start-ups and venture capitalists.

Over 2 years, this group worked on new generation capabilities, starting with a clean sheet of paper, without being limited by traditional work processes or out-dated thinking. They built the enterprise strategy on customer experience, and were careful not to be misled by mere technology innovations. The result was in three-parts:

Exponential Processes: Through Outcome Based Processes with trust & control (data algorithms to approve expense reports)

Exponential Technologies: Through Total Automation with IoT, Machine Learning, AI & RPA, redefining scale from scarcity to abundance

Exponential Ecosystem: Through Human Capital on Demand by crowd sourcing, and dissolving organizational boundaries by platforms across the organization (like LinkedIn/Airbnb driving new business models)

The projects were characterized by high risk/high return, with 10x improvements instead of the usual 20 to 30%. The thought was that even if 2 out of 10 projects would be successful, the benefits would far exceed the investments because of the disruption it would drive. More than the tools, the end goal was driving the NGS strategy. Companies like P&G are embracing disruption as a game-changer - from its products to its services - demonstrating their future readiness.

*Summarized from the Published Interview of Tony Saldanha

Voice of Customer and Delivery Excellence is an excellent combination to align what GBS thinks of its delivery with what the customers perceive they are getting.

ACT 2 – Customer Excellence

(A) Voice of Customer and Delivery Excellence is an excellent combination to align what GBS thinks of its delivery with what the customers perceive they are getting. In our interactions with GBSCs, we have seen organizations do not carry out regular or periodic VoCs with their HQ as there is a belief that both belong to the same company. Or, GBS may believe that they are moving up the maturity curve in terms of Delivery Excellence, but do not validate this with their internal customers. Both are not good practices for an effective GBS operation. Hence, this is the best place to start for Assess Stage as there is always a ‘gap or disconnect’ between GBS and the key stakeholders. This can also establish the Net Promoter Score (NPS) for the GBS.

(C) Post the Assess Stage, the Connect Stage enables action on ways and means to increase the NPS. This stage ensures an alignment of Delivery Excellence with Customer Expectations, implements a structured process for customer engagement with business and service functional heads to understand and deliver on the critical customer journeys.

(T) An effective NPS helps progress towards Customer Experience Management (CEM) – the Target Stage. Quite often, GBSCs tend to use the concept of CEM without even having a proper VoC, Delivery Excellence validation, or a customer engagement program. The sequential focus on CEM in the Target Stage will, therefore, provide solid credibility to connect with internal customers and even external customers, jointly with the internal customers.

ACT 2 is a key track that connects ACT 1 of GBS or ES as a Business to sustain collaboration with customers, built on a strong business orientation.

ACT 3 – Core Business Expertise

In the history of two decades of offshoring, GICs and GBSCs, the domain expertise is an expectation that GBSCs always seen to be falling short of. For the sake of clarity, Domain Business refers to the Core Business of the parent company – be it, Insurance or Fast Moving Consumer Goods. Without this anchoring track, being future ready would remain a myth.

(A) The Assess Stage is to understand the current state of domain knowledge across GBS population, at Prelim, Intermediate and Advanced levels, corresponding to the roles and leadership. GBSCs need to have domain focus on the industry and not just the parent company. They should extend their analysis to parent company’s competition as well (in all forms – traditional and emerging) and the way customers are serviced by others (strategic triangle of company, competition and customer). They should then plan and establish a robust Domain Expertise Development Centre with faculty from parent company, Train-the-Trainer for domain knowledge, assessments tests to certify the levels of completion, and metrics to monitor domain expertise development at the GBSC. All of this should then be reported periodically to the key customers of the parent company. Technology, being all pervasive to all businesses, the domain expertise is the foundation to leverage this power for business.

(C) The domain expertise focus leads to the Connect Stage of creating a Next Gen Services (NGS) Hub within GBS to identify projects to leverage domain knowledge with new workplace processes and technologies.

(T) NGS provides the right platform to go to the Target Stage of delivering value by linking technology with business growth. This is a long haul activity and requires urgent attention of all GBSs who are serious in getting future ready, as shown in the P&G case study.

ACTs 1 to 3, taken together, will really provide the much-talked-about-but-often-never-realized ‘seat at the table’ for the GBS lead with the Business Leaders of the parent company. Without these ACTs, seat at the table will remain just a good talking point and never happen.

ACT 4 – Operating Models

GICs, by design, are In-house and fall under the Captive Operating Model. However, GBSCs need to go beyond captive operations to encompass managing many operating models as appropriate to its business process value chain, and fit to the corporate philosophy. Quite often, outsourcing happens in parallel to GIC or GBS Ops, without a direct link to GBS. This is sub-optimal from the overall business points of view. Also sometimes, the corporate philosophy mandates creating only ‘captive’ GICs even when alternative models may be more effective to get the best out of the BPM ecosystem. Whichever operating model is adopted, there is a need to pin the delivery accountability on the provider, and not pass this on to the parent company.

(A) Hence, at the Assess Stage, it is necessary to establish the Process Value Chain for the operations residing within GBS – be it, captive or third party and carry out a zero base review to determine which operating model is more suitable. This can also lead to a situation where the Shared Services in one location can be spun off to a third party with relevant expertise; or pulling back some from the outsourced operations to in-house model. A Sourcing Management Office (SMO) with internal leadership and external experts can be a good way to initiate and monitor this. The SMO can review and reimagine the operating models from a clean slate and take the necessary step forward to the Connect Stage action.

(C) Besides the Captive and Third Party operating models, there are innovative solutions and models that have come up like ‘Dedicated Captive’ (DCap) where the centre provides exclusive services to GBS or if there is no GBS, to the parent company. This is not a virtual captive which BPOs have carried out in the past. The DCap model provides the right blend of In-house flexibility, exclusivity of people and operations and control with minimum investment enable setting up operations with best business process expertise, and as a business. This innovation comes from the best practices of manufacturing space, where sub-contracting has been successfully adopted and is an unbeatable combination for corporations seeking to have control with delivery excellence.

(T) The crux to future readiness is for the GBS to have ‘end-to-end accountability’ with hybrid operating models, which is the Target State. Without this, there is no way the next level movement on the overall effectiveness or future readiness can be achieved.

ACT 5 – Capability Development

Capability Development (CD) is another phrase that is much talked about but not adequately measured in GBS Quite often it is linked in a limited way to Leadership & Skill Development. In reality, this term is all encompassing and covers Knowledge Management, Innovation, Performance, Contracting, and Intellectual Property to name a few.

(A) Practically for sustaining future readiness, CD is an important ACT and needs a structured approach. For this, there is no model better than eSourcing Capability Model (eSCM), developed by the Carnegie Mellon University and now managed by the ITSqc. eSCM is a great way to start the Assess Stage of ACT 5 and benchmark to get a holistic view of multiple aspects of capabilities. eSCM covers 10 capabilities, 84 best practices and about 700 sub practices, with focus on CAPA (Corrective Action, Preventive Action), process capability base-lining, service design, relationship management etc.

(C) Based on this Assess output, actions are prioritized from the company point of view for the Connect Stage towards Organizational Capability Development (OCD) covering all the 10 capabilities in a holistic manner. It covers multiple dimensions like digital culture, process capability enhancement to adopt technology, process candidates for digital technology, digital execution assessment, etc.

(T) Given the impact technology change has on all aspects of GBS, OCD is the spring board for Digital Execution in the Target Stage. By design, Digital Execution is ‘holistic’, and NOT just limited to technology. This is also the foundation for Exponential Technologies under ACT 7 covering digital aspects like AI, IoT, AR, VR, etc.

ACT 6 – Work Place Environment

(A) This is one area where unexpected changes are still happening. The Assess Stage will aim to identify key skills like entrepreneurship, design thinking, commercial acumen, basics of data science, and everything that is connected with changing work place or place of work.

(C) Built on this, the GBS will work to ensure development of Workplace Management skills under the Connect Stage for employees at various levels. One important requirement will be for people to ‘manage not just other people but also bots’. In addition, the abilities to manage hybrid models, big data analytics, open ecosystem of tools available for various processes, business intelligence, business partnership etc. will sustain the various actions taken under all ACTs.

(T) With this, the Target Stage is to get ready with workplace leadership skills that are crucial to create a talent hub and focus on multiple dimensions of new age requirements like NGS, reimagining work processes using exponential technologies, exponential ecosystem, etc.,. Global In-house Centres then truly become Global Capability Centres of and for the parent company’s business.

ACTs 4 to 6 together ensure that GBS is able to leverage the seat at the table achieved from ACTs 1 to 3 and drive its own destiny’ for GBS to make a difference to the parent company and key stakeholders. This ensures alignment of all GBS strategic actions to deliver on the corporate HQ and business/ services priorities.

Every GBS which can embark on this highway of 7 Tracks for future readiness can truly become a strategic asset and a valuable line of business for the parent company.

ACT 7 – Technology Focus

(A) This ACT, as already seen, is the pivot on which the future of GBS lies. The Assess Stage is obviously a focus on IT landscape of what is within the company, what kind of innovation is happening outside, and what changes are being implemented as of now. Identifying process candidates for RPA and initiating some pilots can be part of Assess stage to plan the big step forward.

(C) Based on the IT landscape, a project with all stakeholders needs to be created to mitigate the miseries of traditional IT or legacy IT and work closely to enable traditional IT digital ready. The GBSCs should also aim at reducing cost on traditional IT and funnelling investments for future technologies – since this is a high priority for the CIO and the Business Leaders. This is easier said than done, but is inescapable as it provides the cutting edge to the GBS to become future ready in the eyes of the parent company and other stakeholders – in particular its own employees. Implementation of RPA and adopting AI could be growing as part of this stage, but a dominant focus on making traditional IT digital is a must in Connect stage, if GBS wants to showcase its Capabilities of providing Technology edge to parent company.

(T) Combining the power of digital ready IT, the landing point as a Target is the Exponential Technologies that covers AR, VR, AI beyond RPA and other automation areas. Quite often, GBSCs jump straight to advanced technologies without having established the Target Readiness on other ACTs as outlined here. Connect and Target Stage readiness in ACT 1 to 6 will make the future readiness in technology a positive experience, with a smooth and soft landing.

ACT 7 on technology is all encompassing, impacting the other six tracks – ACTs 1 to 6. It has a virtual cycle effect on enhancing the power and outcomes from the other ACTs.

Way Forward

GBS of the future is packed with a lot of action and lots to accomplish – great potential and great opportunities.

ACTs 1 to 7 as a framework has been built on learning from GBSCs and the current assessment of the future. The sequence from ACTs 1 to 7 is to go from Assess Stage of ACT 1 to Assess Stage of ACT 7 and then navigate the journey forward to Connect and Target, as each track gains sponsorship, engagement, momentum and results. With fair degree of conviction, one can claim that these tracks will truly become the 7 Tracks of Highly Effective and Future Ready GBSCs.

Every GBS which can embark on this highway of 7 Tracks for future readiness can truly become a strategic asset and a valuable line of business for the parent company. Also, when converted into a reality, the GBSCs will have the enviable combination of bringing the advantages of both profitability and end-to-end process perspectives for the success and growth of the core business.

ABOUT THE AUTHOR

Ravi S Ramakrishnan is a seasoned business and people leader with invaluable experience of 35 years in finance, business and business process areas. He was instrumental in setting up the pioneering global offshoring operations at American Express. Having held leadership positions earlier in Hindustan Unilever, Murugappa Group and Eicher with CXO level responsibilities,

Ravi is recognized as a thought leader in off shoring and business process domains. He uniquely combines exposure to multiple sectors of Indian and global corporations, and drives the vision and strategies for growth of RvaluE in the niche area of business process services through a team of professionals. Ravi is a Chartered & Cost Accountant and a Company Secretary.

Ask an Expert

Ask an Expert